Last week: It was another choppy week given continued indecision with the US$ index but there were still some decent trend line breakout trades, and TC trades for my Trial participants, to be had. There have been a few late additions to the economic calendar with some ECB Draghi speeches and a Fed Chair Yellen speech and I’m wondering if one or other of these might get the US$ going and thereby help currency movement?

Trend line breakout trades: these trades were noted during the week here, here and here with the pip and point tallies being:

- Gold: 100 pips.

- GBP/JPY: 100 pips.

- USD/TRY: 290 pips.

- USD/MXN: 2,400 pips.

- EUR/AUD: 100 pips.

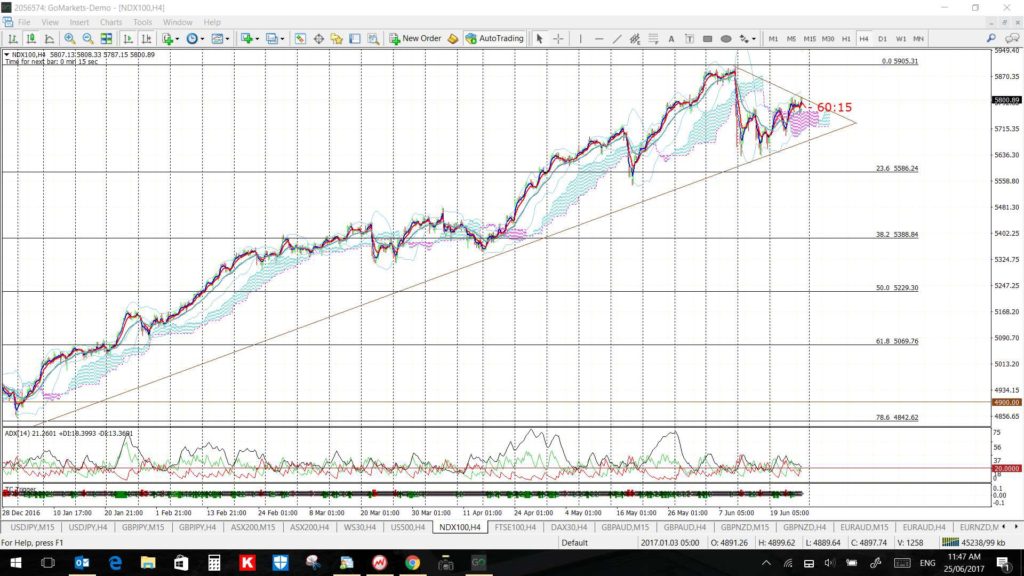

- NASDAQ-100: 80 points and later in week for 65 points.

- DAX-30: 190 points.

- DJIA: 150 points.

- JP225: 260 points.

- S&P500: 10 points.

This week:

- US$: The US$ and EUR$ indices both closed with bullish coloured indecision-style ‘Spinning Top’ candles last week. There is a fair bit of USD and EUR data that could get the US$ moving this week so watch out for this potential and, if so, take care with the FX Cross pairs as they could be more choppy than usual. A review of the FX Indices can be found through this link.

- NZD/USD: this is holding up rather well and I read many are bearish and looking to SHORT at 0.73. However, a close and hold above this key level would be rather bullish.

- Month end: The month of June, and this trading quarter, close on Friday so watch for any month-end flows and, after that, for new monthly pivots.

- Gold: closed with a bullish-reversal Hammer candle above $1,250 support. Take care if you’re wanting to SHORT here!

- Podcast: this 20 minute podcast on the situation in Qatar is worth listening to.

Calendar: Data to monitor includes:

- Mon 26th: EUR German Ifo Business Climate and an ECB Draghi speech. USD Core Durable Goods.

- Tue 27th: NZD Trade Balance data. USD a Fed Chair Yellen speech and CB Consumer Confidence. EUR an ECB Draghi speech. GBP Financial Stability Report and a BoE Gov Carney speech.

- Wed 28th: USD Crude Oil Inventories. EUR an ECB Draghi speech. GBP a BoE Gov Carney speech. JPY BoJ Gov Kuroda speaks.

- Thurs 29th: USD Final GDP & Weekly Unemployment Claims.

- Fri 30th: CNY Manufacturing & Non-Manufacturing PMI. GBP Current Account & GDP. USD Revised UoM Consumer Sentiment.

TC Trial Traders: TC Trial traders realise the benefit of waiting for the optimal type of TC trade entry signal which is:

- a New TC signal that triggers with a 4hr chart trend line breakout and that requires a small Stop. ‘Small’ is a relative term but I look for Stops of less than 30 as being preferable.

The current choppy market conditions are generating fewer of these ‘Optimal’ style of TC signals but they can be found. There were some great trades during the week on the ASX-200, USD/TRY, Silver, Crude Oil and the JP225 index to name a few. There were some Optimal TC signals available on Friday, as well as a couple of other TC signals, and the before and after screen shots of the 15′ charts are shown below.

The fact that there have been fewer of the Optimal type of TC signals is a reflection of the current choppy markets and is a built-in form of protection from being dragged into poor trades. I was always concerned about staging the 8-week TC Trial across the potential Summer ranging ranging markets of June/July but that could not be avoided.

One TC Trial trader mentioned to me that the TC system might be able to fare better than other trading systems during the Summer-style ranging markets and these Friday trades seem to highlight this. The pip movements were not huge but, with the smaller required Stops, the Risk to Reward factor (R) made the trades worthwhile!

Gold: this signal evolved with the bounce up from the $1,250 S/R trend line, that I had noted to watch, and gave up to 65 pips which was a 2R trade (click on the charts to enlarge the view):

GBP/JPY: this signal evolved with the break of the 4hr chart trend line and was a Continuation TC signal for just over 1R but there may be more to come with this breakout move:

NZD/USD: this signal evolved with a New TC signal and the break of the 4hr chart’s triangle trend line for around 3R:

EUR/USD: this signal evolved with a new TC signal, that triggered whilst price was within the larger trading- channel pattern, but this gave up to 3R:

AUD/JPY: this signal triggered within a larger triangle technical pattern but gave a New TC signal for up to 3R:

Silver: this gave a New TC signal but the trend line above limited scope of movement here:

USD/JPY: this gave a New TC signal as well but it was a losing trade. However, the prior choppy price action may have kept some traders out of this trade. Candlestick price action with lots of ‘Shadows’ (aka ‘choppy’) is something that TC Trial traders are warned about!

Forex:

EUR/USD: The EUR/USD has continued chopping sideways in a trading channel making this 5 weeks of doing so.

Watch the 4hr chart’s channel pattern for any breakout move:

- Upper targets: any bullish breakout will focus 1.15 as previous S/R followed by 1.18 as the daily chart triangle breakout target.

- Lower targets: any bearish breakout would have me looking for a test of 1.095 S/R followed by the daily chart’s broken trend line. After that, the 4hr chart’s 61.8% Fib.

Remember: The yield from the earlier triangle breakout remains around 280 pips of a projected move that could be worth up to 800 pips. The target for the daily triangle breakout move is up near 1.18 and this is near the upper edge of the trading range for this pair since the start of 2015 (shown on the weekly chart below).

There are three ECB president Draghi speeches to navigate this week as well as a Fed Chair Yellen speech plus other US data.

EUR/JPY: This pair has also continued chopping sideways in a wide trading channel making for 6 weeks of doing so now. I applied a smaller 4hr chart triangle within this channel late last week and there was a trend line breakout with a TC signal from this on Friday; as the 15 min chart shows. FWIW: The EUR/JPY remains above a previously broken 2 ½ bear trend line.

Watch for any continuation from the recent 4hr chart’s triangle breakout:

- Upper targets: any bullish continuation would have me looking for a test of the upper trend line of the 6-week channel followed by the weekly chart’s 61.8% Fib, near 135.

- Lower targets: any bearish pullback would have me looking for a test of the 4hr chart’s bottom channel trend line followed by the daily chart’s broken 2 ½ bear trend line, which is near the 4hr chart’s 50% Fib.

AUD/USD: The Aussie pulled back this week to test the recently broken 4 ½ year bear trend line and key 0.755 S/R level but managed to close above both of these to see out the week. It closed the week with a bearish candle but this was an indecision-style ‘Inside’ candle.

Any continued hold above this trend line could represent the start of the daily chart triangle breakout worth up to 1,700 pips; a pattern that I have been on about for some weeks now.

Watch the new 4hr chart’s bullish descending wedge pattern, the 0.755 and 4 ½ year bear trend line for any new make or break:

- Upper targets: any bullish breakout would bring 0.76, and then 0.77 and other whole numbers followed by the monthly chart’s bear trend line, near 0.90, into focus.

- Lower targets: any bearish breakout would have me looking for a test of the daily chart’s 17-month support trend line and, after that, the monthly chart’s 61.8% fib which is near 0.72.

There is no high impact AUD data but watch for USD data and for Friday’s CNY Manufacturing and Non-Manufacturing PMI data.

AUD/JPY: The AUD/JPY paused after a bullish two week run but this is giving the 4hr chart a Bull Flag appearance with a new 4hr triangle in play.

Watch the 4hr chart triangle, set within the daily chart triangle, for any new breakout:

- Upper targets: any bullish breakout would bring the upper triangle trend line from the daily chart triangle and, then, the 85 and 87 S/R levels into focus.

- Lower targets: any bearish breakout would have me looking for a test of the bottom trend line of the daily chart triangle followed by 80 S/R and then the daily chart’s 61.8% Fib near 79 S/R and then 75.

NZD/USD: The Kiwi remains above a recently broken 3-year bear trend line and the key 0.72 level and was consolidating within a 4hr chart triangle until Friday. Price action broke up and out from this triangle though and note the supporting 4hr chart momentum that came with this move.

The key 0.73 level is just above current price and will be the level to watch this week for any make or break activity. The Kiwi has printed six bullish weekly candles in a row here now though and, with the weight of people wanting to SHORT at 0.73, there could be a pullback from this region.

Watch for any continuation from the the 4hr chart triangle breakout:

- Upper targets: 0.73 and 0.74 as previous S/R followed by the weekly chart’s 61.8% fib near 0.79.

- Lower targets: 70, being the 4hr chart’s 61.8% fib and near the monthly pivot, and then 0.67 S/R.

There is NZD Trade Balance data this week and Friday’s CNY Manufacturing and Non-Manufacturing PMI data as well as all of the US data.

GBP/USD: The Cable was trading within a descending wedge under the key 1.30 level until Friday but looks to be trying for a bullish breakout. Note the increase in bullish momentum that is visible now on the 4hr chart.

Watch the 4hr chart wedge trend lines for any continued breakout effort:

- Upper targets: any sustained bullish breakout will bring 1.30 and then 1.35 as previous S/R followed by 1.40, which is near the 3-year bear trend line into focus.

- Lower targets: any bearish retreat will bring the 4hr chart’s 61.8% Fib, near 1.25, into focus.

There is a fair bit of GBP data to navigate this week with the GBP Financial Stability Report, two BoE Gov Carney speeches and GBP Current Account data as well as US data.

USD/JPY: The USD/JPY essentially chopped sideways under the 112 level last week and remains trading within a Flag pattern.

Watch the 4hr chart’s Flag trend lines for any breakout move:

- Upper targets: any bullish breakout will bring the 112 level and then the daily chart’s upper triangle trend line into focus.

- Lower targets: any bearish breakout will bring the daily chart’s lower triangle trend line into focus.

There is a BoJ Gov Kuroda speech to navigate this week as well as US data.

GBP/JPY: The GBP/JPY spent last week consolidating after the recent bullish breakout from the 6-week descending trading channel. Recall that that this channel was set within a larger daily chart triangle.

This consolidation formed up a triangle pattern on the 4hr chart but price broke up an out from this on Friday. However, I’ve revised the trend lines here so watch for any new breakout:

- Upper targets: the 4hr chart’s 61.8% fib, near 114.50, and then whole numbers but especially 147, as previous S/R and then the 22 month bear trend line followed by the weekly chart’s 61.8% Fib, which is up near 168.

- Lower targets: any pullback would have me looking for a test of the daily chart’s triangle support trend line and then the 139 level.

GBP/AUD: The GBP/AUD made a slow breakout from a recent descending broadening wedge after holding above the 4hr chart’s 61.8% fib support. The price action has been rather messy but I’ve revised the trend lines into a new 4hr chart triangle giving traders trend lines to watch for any new breakout.

GBP/AUD: The GBP/AUD made a slow breakout from a recent descending broadening wedge after holding above the 4hr chart’s 61.8% fib support. The price action has been rather messy but I’ve revised the trend lines into a new 4hr chart triangle giving traders trend lines to watch for any new breakout.

I’d mentioned last week that price action might be rather choppy and this has been the case so watch for any ‘more of the same’.

Watch the 4hr chart’s triangle trend lines for any breakout:

- Upper targets: The 1.75 level, then 1.80 as previous S/R and, then, the 20-month bear trend line.

- Lower targets: any pullback would have me looking for a test of the 4hr chart’s 61.8% Fib, near 1.65, followed by 1.601 S/R.

GBP/NZD: The GBP/NZD remains within a descending trading channel and near the 78.6% fib of the recent swing high move on the 4hr chart.

Watch the 4hr chart’s channel trend lines for any new breakout:

- Upper targets: The 1.77 followed by 1.80 level and then the monthly charts bear trend line and then 1.90 as previous S/R and, after that, the weekly chart’s 61.8% Fib near 2.20 S/R.

- Lower targets: any deeper pullback would have me looking for a test of the 1.67 S/R level.

EUR/AUD: This pair broke out from a bullish descending wedge last week but stalled under the 4hr chart’s 200 EMA.

Watch for any continuation from this 4hr chart wedge breakout:

- Upper targets: any bullish continuation will bring the 1.50, then the 9-year bear trend line and then the previous S/R level of 1.55 into focus.

- Lower targets: any bearish pullback will bring the 4hr chart’s 50% Fib, near 1.42, and then the 1.40 level into focus.

EUR/NZD: The EUR/NZD is trading within a 5-week descending trading channel and just above the 4hr chart’s 78.6% fib level.

Watch the 4hr chart’s channel trend lines for any breakout:

- Upper targets: any bullish breakout will bring the key 1.60 and then the 1.675 S/R region, followed by the 9-year bear trend line into focus.

- Lower targets: any bearish breakout will bring the 4hr chart’s 100% Fib, near 1.50, into focus.

USD/CNH: This pair finally took on the 61.8% fib of the recent swing low move last week. Price had been consolidating within a triangle for much of the week but broke out late on Thursday. There was a new TC LONG signal here but the required Stop was rather large at 60 pips so not the greatest R/R trade.

I’ve revised the 4hr triangle and this has the apex near the 61.8% fib so watch this for any new breakout:

- Upper targets: watch for any bullish breakout move to test the upper bear trend line from the daily chart’s channel.

- Lower targets: any pullback would have me looking for a test of the recent low, near 6.70, followed by the weekly chart’s 50% fib near the previous S/R level of 6.50.

USD/TRY: This pair remains trapped within a 6-month Flag pattern but, set within this, there is a recent 4hr chart triangle pattern.

Watch the 4hr chart’s triangle trend lines for any new breakout:

- Upper targets: any bullish breakout will bring the daily chart’s upper Flag trend line followed by the key 4 level as long-term resistance into focus.

- Lower targets: any bearish breakout below the daily chart’s lower Flag trend line will bring the weekly chart’s 61.8% fib and, after that, the 3.10 region as previous S/R into focus.

USD/MXN: The USD/MXN pulled back higher this week and tested the recently broken Flag trend line. I note, with interest, how it failed to close and hold back above this region that was once support but is now resistance.

I also note that the weekly candle closed as a bullish-reversal ‘Inverted Hammer’ right at the 18 level and the weekly chart shows 18 as a recent S/R zone. Thus, watch this region for any potential bounce activity.

This Flag still represents a potential 25,000+ pip Bear Flag move so watch this bottom Flag trend line and the 18 S/R level for any new make orbreak.

- Upper targets: 19 followed by the upper Flag trend line.

- Lower targets: the weekly chart’s 61.8% fib near previous S/R of 16.

Commodities:

Gold: Gold continues to hover below the 6-year bear trend line but managed to bounce up from the 4hr chart’s 61.8% fib last week and to also close back above the key $1,250 level with a bullish-reversal Hammer weekly candle. Price action is now in a new 4hr triangle under the next S/R level of $1,265.

Watch the 4hr chart’s triangle trend lines for any breakout:

- Upper targets: any bullish breakout will bring the $1,265 S/R level followed by 6-year bear trend line, then the $1,280 level and, then, the weekly chart’s 61.8% fib near $1,600 into focus.

- Lower targets: any bearish breakout will bring the 4hr chart’s 61.8% fib level, near $1,240, into focus.

Silver: Silver remains increasingly squeezed towards the apex of a multi-month triangle and still under the 6-year bear trend line. Price action bounced up off the bottom triangle trend line last week so watch to see if this support continues to hold. The weekly candle closed as a bullish coloured Doji, or sort of ‘Hammer’, candle at this trend line support suggesting a pause, or even bounce, could be in order.

Watch the smaller 4hr chart triangle for any new breakout:

- Upper targets: any bullish breakout will bring the 6-year bear trend line into focus.

- Lower targets: any bearish breakout below the daily chart’s bottom triangle trend line will bring whole-number levels into focus.

Oil: Oil remains within a descending channel as it continues lower and has now pulled back to the weekly chart’s 50% fib. I’ve been reading that people consider Oil in a bear market but I beg to differ given it hasn’t reached the weekly chart’s 61.8% fib level. I’m watching for any move down to test the 61.8% fib, near $38, although the $40 level might form up decent support if price gets down that far.

FWIW: Any move down to the $40 level helps to shape up the lop-sided Inverse H&S on the monthly chart though so, IMHO, that it a key level to monitor.

Watch the descending trading channel trend lines for any breakout:

- Upper targets: any bullish breakout will bring whole number levels and then the daily/weekly/monthly chart’s upper trend line into focus.

- Lower targets: any bearish breakout will bring the $40 S/R level and then the weekly chart’s 61.8% Fib, near $38.50, into focus.

Note: There is 2-year bear trend line above current price and this also forms the monthly chart’s ‘Neck Line’ for a potential ‘Inverse H&S’ pattern. This pattern has a height of approximately $30 or 3,000 pips and this puts the target for any breakout move up near the $85 level which ties in with the 50% Fibonacci of the 2008-2016 swing low move.

Stock Indices: watch the following 4hr chart patterns for any new trend line breakout:

S&P500:

DJIA:

NASDAQ-100:

FTSE-100:

DAX-30:

ASX-200:

JP225:

STOXX-50: