The US$ traded lower again on Wednesday following a weak lead from the US private payrolls data. The lower US$, higher yields, falling bonds and looming NFP would have been enough to spook stocks but the Fed-Chair Yellen comments about stocks being ‘over-valued’ didn’t help their case either. The EUR seems to be the clear winner out of this recent confusion.

USDX 4hr: this remains below the 95.50 Double Bottom ‘neck-line’. It is now resting just above the daily support trend line. A break and hold below this support would support a deeper pull-back.

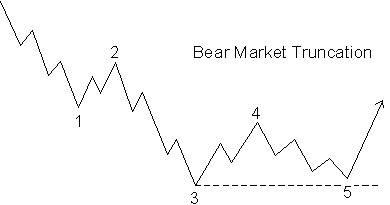

EURX daily: onward and upwards! The Bear Market Truncation pattern continues to play out here:

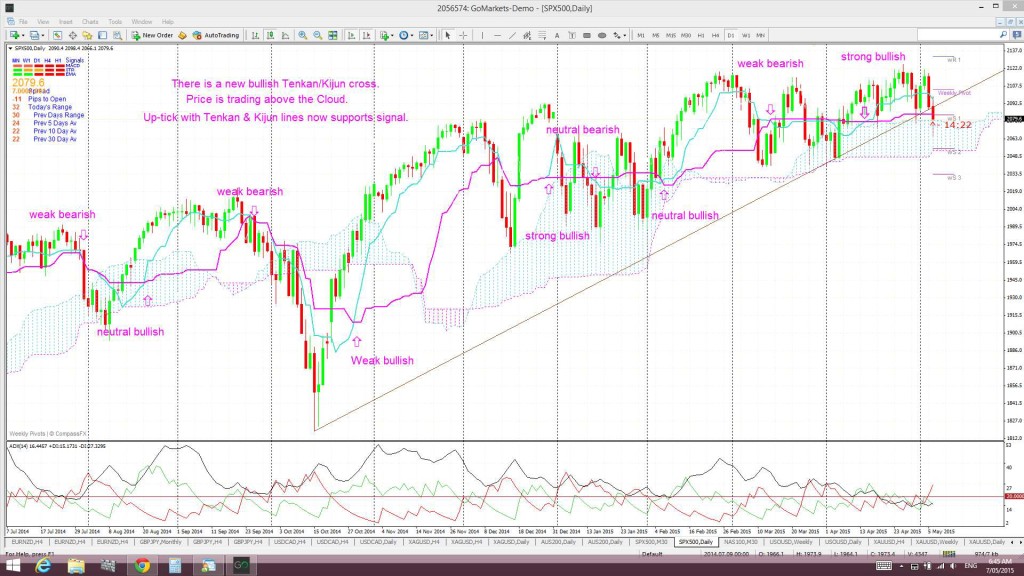

S&P500 daily: the index has broken below trend line support BUT is still above the Cloud for now. Watch for any break and hold below this though:

Silver daily: still edging towards the apex of the monthly chart triangle pattern:

Gold daily: consolidating here too:

Oil daily: might be due a pause as it nears the daily 200 EMA. Note the daily candle formation:

Forex: there is AUD employment data, US Unemployment claims, CAD Building Permit data and the UK Election to come today.

E/U 4hr: the Bull Flag breakout has continued. Any hold above 1.12 is VERY significant as this is the 61.8% fib of the major swing high move:

E/U monthly Cloud: this chart shows the 61.8% fib level more clearly. I had also pointed out the bullish-reversal ‘Railway Track’ pattern over the w/e and this is playing out so far:

E/J 4hr: Bull Flag continuation here too:

E/J daily: watch for any break and hold back above the daily 200 EMA. Note the alignment with the Bear Market Truncation pattern here too:

A/U 4hr: holding above the 0.795 trading channel ahead of today’s Employment data:

A/J 4hr: trading just under the key 96 level ahead of today’s Employment data:

G/U 4hr: stuck between 1.50 and 1.55 whilst waiting for any UK Election outcome news:

G/U 4hr Cloud: also stuck in the 4hr Cloud:

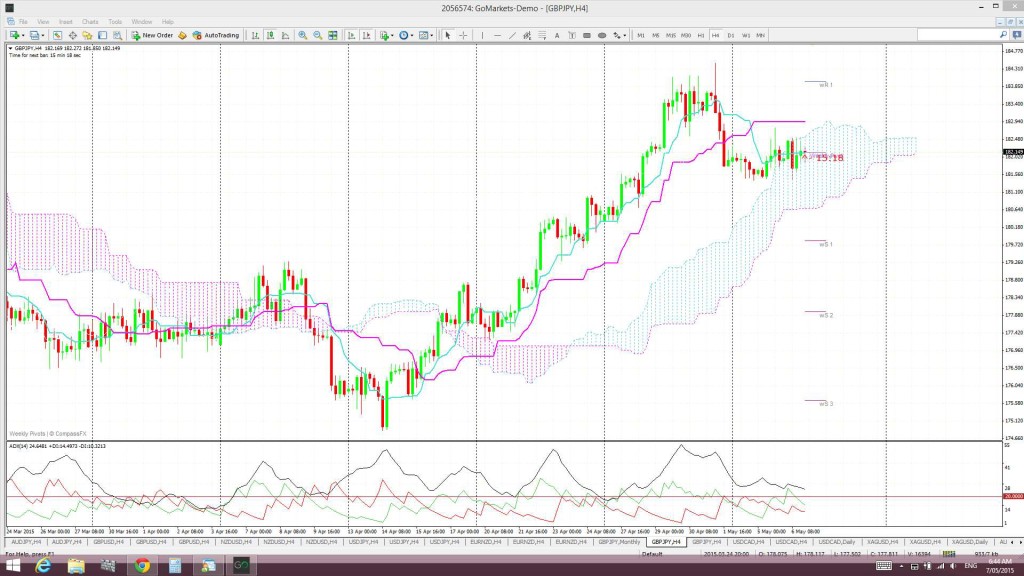

GBP/JPY 4hr: consolidating under the key 184 level whilst waiting for the outcome of the UK Election:

GBP/JPY 4hr Cloud: like the Cable, also stuck in the 4hr Cloud:

Kiwi 4hr: just choppy:

U/J 4hr: lower with the weaker US$ and stocks:

EUR/NZD 4hr: The Bull Flag move continues after giving 280 pips and this will close above the 1.50 S/R level. However, it is now sitting at the 61.8% fib of the recent swing low move.

EUR/NZD daily: the 61.8% fib and the daily 200 EMA are hurdles for this pair but a break and hold above these leaves pretty clear sailing until the monthly chart’s bear trend line:

EUR/NZD monthly: a break and hold above the monthly chart’s bear trend line would be rather interesting. I had pointed out the prospect of a bullish descending wedge here some weeks ago now:

The post US$, stocks lower ahead of NFP with EUR winner for now. appeared first on www.forextell.com.