The weaker than expected NFP result put pressure on the US$ and the index broke the last level of support and closed with a bearish weekly candle. The FX Indices are aligned for ‘risk on’ and so I’ll be watching to see if this is translated into FX trading in coming sessions.

USDX weekly: a bearish weekly candle close below the weekly Ichimoku Cloud. This break below the weekly Cloud has me now watching the following levels:

- the bottom trend line of the symmetrical wedge pattern.

- the 50% Fibonacci level down near 88.

- the 61.8% Fibonacci level down near 85. (Note the amended Fibonacci range here. I’ve captured the whole of the last swing high move now; as I see that is!)

EURX weekly: this index closed with a bullish candle and is getting close to the upper trend line from the 2 1/2 year trading channel so watch for any momentum breakout:

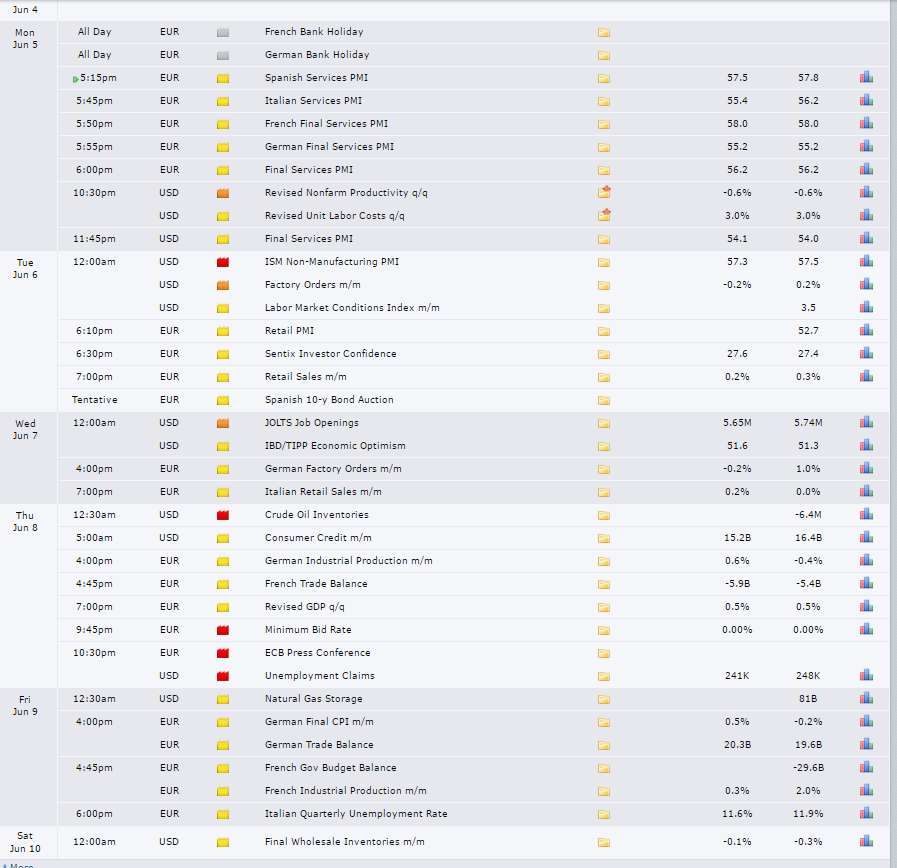

Calendar: there isn’t a lot of USD high impact data, nor EUR for that matter, although there is the all-important ECB rate update: