-

Central banks in Brazil, Norway, Australia all hold meetings

-

Bloomberg Economics’ guide to the world economy’s week ahead

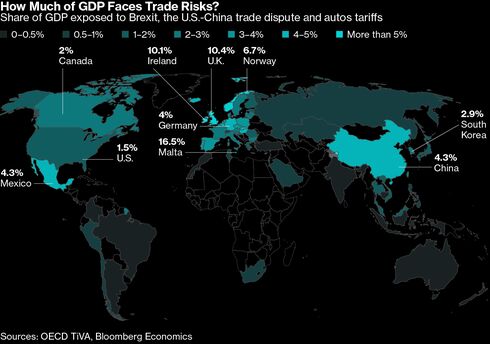

An end to the months-long trade conflict between the world’s two-largest economies may be looming into sight.

President Donald Trump and Chinese President Xi Jinping will decide after negotiations this week in Washington whether they’ll meet to sign off on a pact. White House spokeswoman Sarah Sanders said Thursday that the U.S. sees such a meeting as likely.

Concluding a deal will hinge on the two sides resolving the stickiest issues in their dispute. They include an enforcement mechanism to police the agreement and a decision over whether tariffs will be removed or stay in place, according to people briefed on the talks.

“A Sino-U.S. deal would be a positive for the global economy, when the outlook is dimming and the U.S. is threatening to raise trade tensions with the European Union,” said Chang Shu, chief Asian economist at Bloomberg Economics. “A deal would also certainly help to relieve the short-term stress on the Chinese economy, as well as facilitate structural reforms.”

For central bank watchers there are monetary policy decisions being made across the world as most turn more dovish.

Here’s our weekly rundown of key economic events:

U.S. and Canada

The consumer price index, to be released on Friday, will test Federal Reserve Chairman Jerome Powell’s assessment of tepid inflationary pressures as “transitory.” A rebound in apparel prices will likely bring the pace of monthly gains in the rate back into 0.2 percent territory and push the year-over-year pace up to 2.1 percent, according to Bloomberg Economics. Surging gasoline prices is seen driving headline CPI inflation higher. The producer price index is published the day before. Bank of Canada Governor Stephen Poloz speaks on Monday.

For more, read Bloomberg Economics’ full Weekahead for the U.S.

Asia

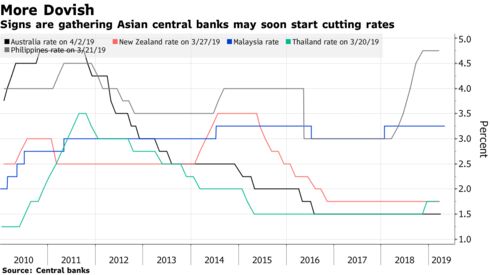

Central banks in Australia, New Zealand, Malaysia, Thailand and the Philippines will all decide monetary policy amid gathering signs the region is going to soon start cutting interest rates. Reductions in the Philippines and Malaysia are likely and the Australians and Kiwis could act too.

For emerging Asia, that would mark a change in course from last year, when countries like Indonesia and the Philippines were among the world’s most aggressive movers as the Fed tightened policy. The Fed’s policy pause has created room to shift interest rates lower, but with higher oil prices and Powell pushing back against pressure to cut borrowing costs, that window for action may begin to narrow. In China, export data will be closely watched on Wednesday for more signs the economy is stabilizing.

For more, read Bloomberg Economics’ full Weekahead for the U.S.

Europe, Middle East and Africa

German industrial production and factory orders reports will help determine just how strong the euro area is after data last week showed most of the region surpassing forecasts in the first quarter. Industrial production, which is released on Wednesday, is though predicted to have declined in March. Concurrent with those data, the final outlook on eurozone growth and inflation from the European Commission before the bloc’s Parliamentary elections will be released on Tuesday. Also on Tuesday, the Norges Bank could signal plans to raise interest rates.

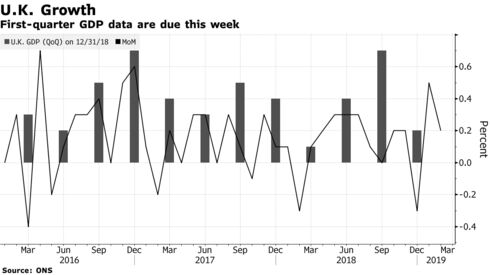

In the U.K., Friday sees the publication of gross domestic product for the first quarter and a monthly number for March, when the economy faced a potential precipice as the Brexit deadline loomed. President Cyril Ramaphosa will look to strengthen his grip on power at elections in South Africa Wednesday as he seeks a mandate to rejuvenate the economy.

For more, read Bloomberg Economics’ full Weekahead for EMEA

Latin America

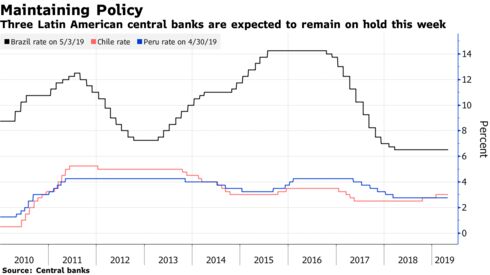

Three Latin American central banks are expected to remain on hold this week. On Wednesday, Brazil will likely keep its key interest rate at an all-time low of 6.5 percent, as uncertainty about the approval of government reforms constrains its ability to cut despite a weak economy. On the following day, Chile is forecast to leave its benchmark at 3 percent after halting a monetary tightening cycle that had started in October. Also on Thursday, Peru is predicted to keep borrowing costs at a record low of 2.75 percent for a 14th straight month as its economy grows below potential.

For more, read Bloomberg Economics’ full Weekahead for Latin America.

By Simon KennedySource: Bloomberg