The US$ remains in a tight range under a broken support trend line and I still consider that trading clarity across FX pairs won’t evolve until there is decisive breakout on this index, either up or down. A range-bound US$ index is not conducive to broader based trend trading.

I emphasise this to urge caution to all trend traders, especially TC Trial participants, to avoid chasing trades that are not there. Wait for the optimal set up to present to you before considering a trade.

TC Trial Participants: please focus on NEW TC signals that evolve with trend line breakout for best results.

Data: there is a lot of second tier data today but only US CB Consumer Confidence as high impact data.

USDX weekly: there needs to be a clear re-take or rejection of this 3-year support trend line to provide trend clarity across many FX pairs.

Forex: the majority of FX pairs remains range-bound in defined technical patterns. The drill remains the same: watch for trend line breakout moves that evolve with increased momentum.

E/U 4hr: there is a lot of second tier EUR data to monitor:

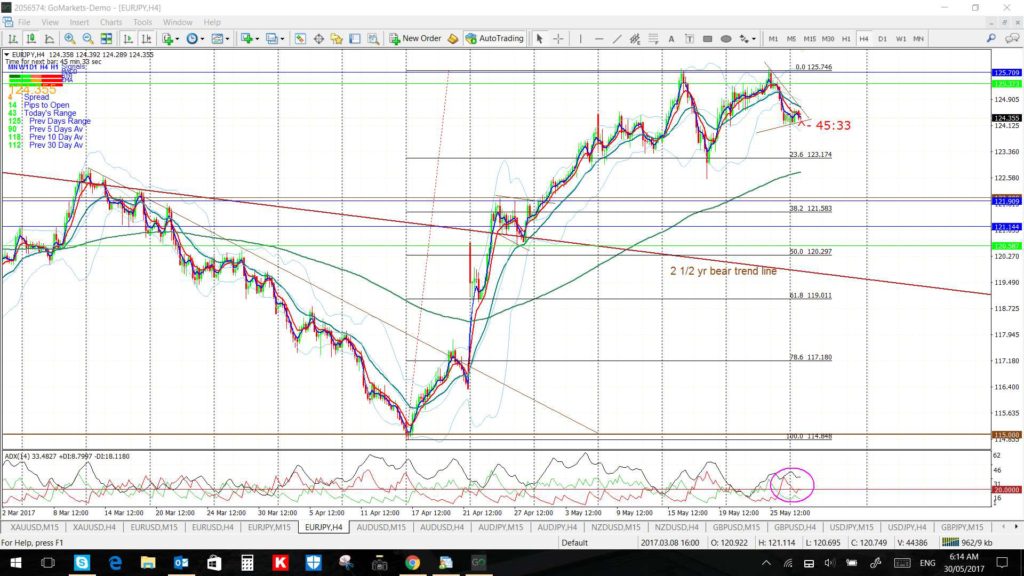

E/J 4hr:

A/U 4hr: Watch today with AUD Building Approvals data:

A/J 4hr:

GBP/USD 4hr:

NZD/USD 4hr: not the best pattern to try to trade!

U/J 4hr: Watch today with JPY second tier Unemployment, CPI and Retail Sales data.

GBP/JPY 4hr: Watch today with JPY second tier Unemployment, CPI and Retail Sales data.

GBP/AUD 4hr:

GBP/NZD 4hr:

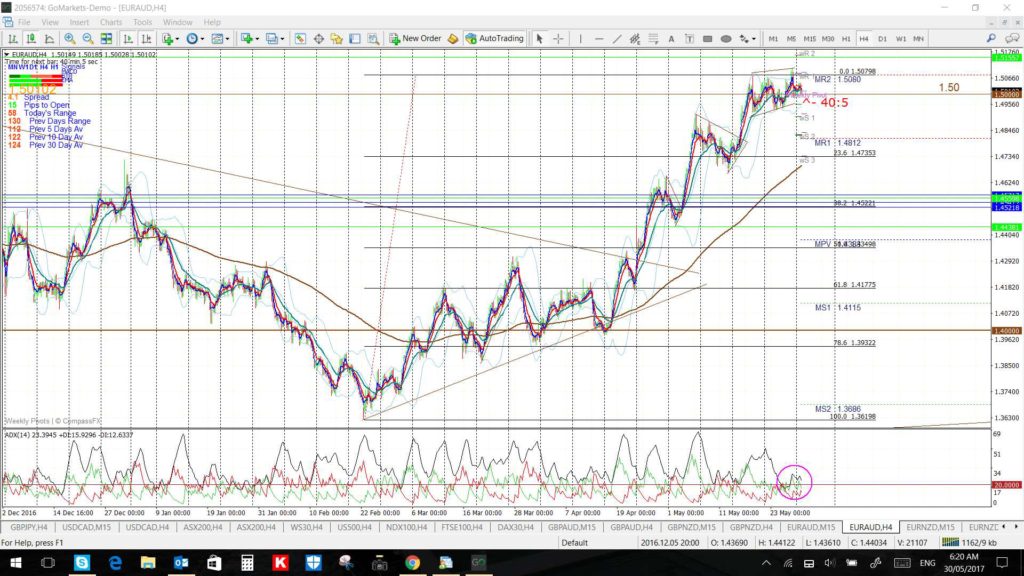

EUR/AUD 4hr:

EUR/NZD 4hr:

USD/CNH 4hr: testing that major support trend line but choppy as it does so. It is a CNY Bank Holiday today:

USD/TRY 4hr:

USD/MXN 4hr:

EUR/GBP 4hr:

Commodities:

Gold 4hr:

Silver 4hr: this is the only one that seems to be on a gradual rise to test the 6-year bear trend line:

Oil 4hr: