The US$ index has held above support following FOMC and this has triggered some movement and TL breakouts. In fact, new breakouts from just yesterday have yielded up to 1,390 pips although the exotic USD/MXN gave 900 of those. Quite a few 15-min chart TC signals triggered during yesterday’s Asian session which is rather unusual. Chart updates today cover Forex, Commodities and Stock Indices, so, grab a coffee.

Data: Watch today with AUD Trade Balance, CNY Caixin Services PMI, GBP Services PMI, CAD Trade Balance and a BoC Gov Poloz speech and and ECB Draghi speech plus the usual USD Weekly Unemployment claims.

USDX: survived the 3-year support trend line but watch as price is squeezed towards the apex of the weekly chart’s triangle:

USDX daily:

USDX weekly: watch to see if this forms a bullish-reversal ‘Morning Star’ pattern:

New Trend line breakouts: these breakout have triggered since my post from yesterday:

EUR/AUD: this move has given 160 pips and note the great TC LONG signal off the 15 min chart once the trend line broke:

EUR/AUD 4hr: the chart from yesterday prior to the breakout:

The 4hr chart today after the breakout:

EUR/AUD 15 min: a great TC LONG signal following the trend line breakout. This move started in the Asian session:

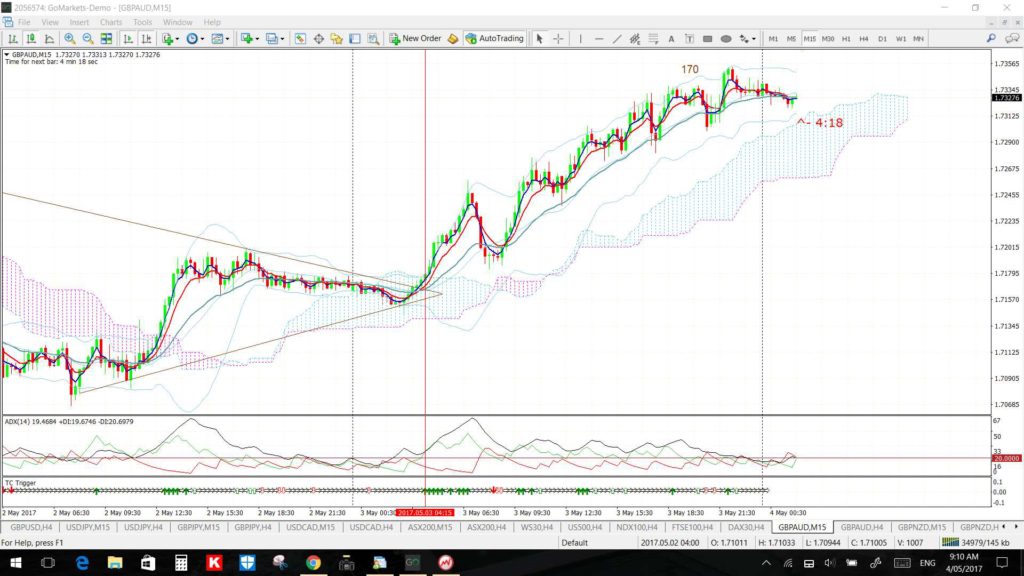

GBP/AUD: this move has given 170 pips and note the great TC LONG signal off the 15 min chart once the trend line broke:

GBP/AUD 4hr: the chart from yesterday prior to the breakout:

The 4hr chart today after the breakout:

GBP/AUD 15 min: a great TC LONG signal following the trend line breakout. This move also started in the Asian session:

EUR/NZD: this move has given 80 pips and also triggered a new TC LONG signal off the 15 min chart once the trend line broke:

EUR/NZD 4hr:

EUR/NZD 15 min:

GBP/NZD: this move has also given 80 pips and triggered a new TC LONG signal off the 15 min chart once the trend line broke:

GBP/NZD 4hr:

GBP/NZD 15 min:

USD/MXN: this breakout move has given up to 900 pips.

USD/MXN 4hr: the chart from yesterday:

The chart today after the breakout:

EUR/JPY 4hr: this breakout has limped on for just 80 pips but watch for any hold above the broken trend line and 122 level:

USD/JPY 4hr: I’d warned in my w/e write up that any bullish breakout might test this daily chart trading channel and…voila! This breakout move is now worth 110 pips!

Other FOREX:

EUR/USD 4hr: watch this Flag for any breakout:

AUD/USD: a wedge breakout may be starting here. Note how the 15 min chart gave a great TC SHORT signal that started during the Asian session yesterday. Watch today with AUD Trade Balance data and CNY Caixin Services PMI:

AUD/USD 4hr:

AUD/USD 15 min: a TC signal here gave 90 pips! I don’t usually find TC works that well on this pair so maybe I should…never say never.

NZD/USD: price has rejected this major trend line but keep watch to see where the weekly candle closes. This also gave a new TC SHORT signal yesterday; after the Asian session though:

NZD/USD 4hr:

NZD/USD 15 min: a great Tc SHORT for 65 pips:

GBP/JPY 4hr: this keeps drifting higher after last week’s break of the long-term trend line::

GBP/USD 4hr: a revised Flag here now as price struggles under the 1.30 level. Watch today with GBP Service PMI:

USD/CAD 4hr: also drifting higher and watch with today’s CAD Trade Balance:

USD/TRY 4hr: choppy under the broken trend line:

USD/CNH 4hr: getting squeezed so watch for any breakout:

Commodities:

Gold 4hr: the 20-week support trend line is now being tested. Watch to see where the weekly candle closes:

Silver daily: the 18-month support trend line is now being tested. Watch to see where the weekly candle closes:

Oil 4hr: choppy under the broken trend line:

Stock Indices: watch the trend lines on each of these 4 hr charts for any momentum-based trend line breakout:

ASX-200:

S&P500:

DJIA:

NASDAQ-100:

FTSE-100:

DAX-30: