-

Treasuries slip after Monday’s surge; dollar, gold edge lower

-

U.S. Treasury Department labels China a currency manipulator

U.S. futures rose alongside European stocks while Asian shares fell after China moved to stabilize its currency, helping ease some of the market turmoil that kicked off the week.

The global sell-off in equities abated after China fixed its yuan exchange rate at stronger than 7 per dollar, a key level that when breached in markets on Monday helped fuel the rout. While the benchmark MSCI Asia Pacific Index fell for a fifth session, the Stoxx Europe 600 rose and S&P 500 Index futures gained, hours after U.S. stocks had their biggest drop of the year on Monday. The yen pulled back from its strongest closing level in more than one year. Bitcoin advanced, with its week-long rally taking the digital token above $12,000 for the first time three weeks.

The dollar and gold nudged lower. Treasuries dropped after benchmark yields on Monday hit the lowest since October 2016. Oil edged higher. The pound strengthened as opponents of a no-deal Brexit hardened their plans to stopPrime Minister Boris Johnson from possibly trying to leave the European Union with no agreement.

Investors are contemplating the brutal start to a week triggered by yet another escalation in the trade struggle between the two largest economies. China’s move to stabilize the yuan offered some reassurance. But it came too late to avoid the “manipulator” designation that could open the door to new penalties on top of the tariff hikes already imposed on Chinese goods. Treasury Secretary Steven Mnuchin will now “engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions,” the department said in a statement.

For its part, China said the recent yuan depreciation was decided by the market, not Beijing, and denied the Trump administration’s accusation.

“The key thing is that they’ve shown they are willing to play with that 7 level,” Andrew Sullivan, Pearl Bridge Partners director, said on Bloomberg TV. “The market really doesn’t have a firm grip on how far the currency could go.”

Elsewhere, the Australian dollar briefly trimmed gains after the central bank kept rates unchanged at record lows, as expected, and said it was reasonable to expect that “an extended period” of low rates will be required. The country’s bonds rallied, sending the 10-year yield below 1% for the first time. Japanese rates fell below the central bank’s target range.

These are some key events to watch out for this week:

- Earnings from financial giants include: UniCredit, AIG, ABN Amro Bank, Standard Bank, Japan Post Bank.

- Central banks with rate decisions include India and New Zealand.

- A string of Fed policy makers speak this week, including St. Louis chief James Bullard on Tuesday and Chicago’s Charles Evans a day later. Both are Federal Open Market Committee voters.

Here are the main moves in markets (all sizes and scopes are on a closing basis):

Stocks

- Futures on the S&P 500 Index jumped 0.8% as of 9:30 a.m. London time, heading for the largest climb in more than a month.

- The Stoxx Europe 600 Index advanced 0.3%.

- The U.K.’s FTSE 100 Index fell 0.1%, hitting the lowest in almost two months.

- Germany’s DAX Index increased 0.4%.

- The MSCI Asia Pacific Index sank 0.8%, hitting the lowest in almost seven months.

Currencies

- The Bloomberg Dollar Spot Index decreased 0.1%.

- The euro was little changed at $1.1202.

- The Japanese yen decreased 0.5% to 106.46 per dollar, the largest dip in four weeks.

- The onshore yuan climbed 0.4% to 7.025 per dollar, the biggest increase in six weeks.

Bonds

- The yield on 10-year Treasuries increased five basis points to 1.76%, the first advance in more than a week.

- Britain’s 10-year yield climbed one basis point to 0.525%, the first advance in more than a week.

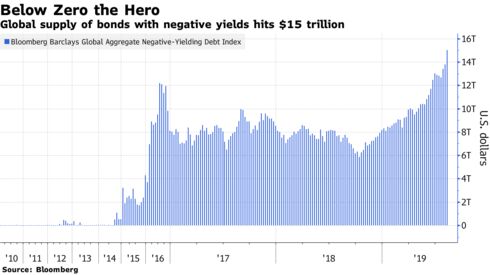

- Germany’s 10-year yield fell one basis point to -0.52%, hitting the lowest on record.

Commodities

- Gold decreased 0.2% to $1,461 an ounce.

- West Texas Intermediate crude climbed 0.7% to $55.10 a barrel.

- Iron ore dipped 1.4% to $94.40 per metric ton, reaching the lowest in more than seven weeks.

By Laura Curtis

— With assistance by David Ingles, Cormac Mullen, and Andreea Papuc

6 August 2019, 18:46 GMT+10

Source: Bloomberg