-

Crude oil jumps after OPEC inches closer to supply cuts

-

China’s economy closely watched with key monthly data due

Stocks were mixed in Asia and futures pointed to a firm start for equity markets in London and New York as investors assessed whether the recent rallies can endure. The pound slid as U.K. Prime Minister Theresa May fought to keep her Brexit divorce plan alive.

Shares drifted for most of the Asian day, with equities in Japan and Hong Kong little changed, while they gained in China. The region’s stocks shrugged off leads from a weak U.S. session on Friday when large-cap tech stocks dragged the Nasdaq 100 Index to a loss of more than 1.5 percent. Oil prices snapped a 10-day sell-off after the bear market for crude spurred OPEC and its allies to start laying the groundwork to cut supply in 2019. Yields on 10-year Treasuries, which don’t trade Monday thanks to a U.S. holiday, ended just below 3.2 percent on Friday.

China’s economy will be in focus this week, with key monthly data due Wednesday. Chinese stocks showed signs of rebounding Monday morning after tumbling last week amid mounting signs of a slowdown, seen in earnings outlooks and moves by regulators to sustain credit flows. While Alibaba Group Holding Ltd. logged another record in its Singles’ Day online-sales extravaganza, that may not be enough to shift sentiment.

“Clearly there’s a deceleration due to the soft macro” picture for the economy, Junheng Li, founder of JL Warren Capital LLC in New York said in reference to Singles’ Day. “But where we can get some comfort from this number is that Chinese consumers are slowing, not collapsing.”

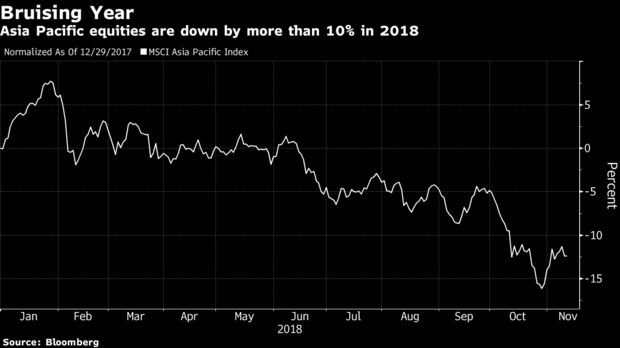

Global stocks are facing pressure again, from China and worries that the most recent earnings season could prove to be a peak. There’s also a renewed debate on the direction of bond yields, with investors dialing down inflation expectations. U.S. consumer prices due this week may offer further hints on the trajectory of costs.

“The relative valuations that we’re seeing across a number of equity markets around the world, compared to what we think the bond market is going to do, does suggest an overweight in global equities makes sense,” said Andrew Milligan, head of global strategy at Aberdeen Standard Investments, which oversees $735.5 billion for clients. “But that does require there to be no big policy errors” from central banks, he told Bloomberg TV in Hong Kong.

Elsewhere, the offshore yuan held on to last week’s drop, with little sign of an end to the U.S.-China trade war in the wake of the midterm elections.

Terminal users can read more in our Markets Live blog.

Coming Up

- U.S. bond markets are closed Monday in observance of Veterans’ Day

- San Francisco Fed President Mary Daly speaks on the economic outlook at a regional development conference in Idaho Falls, Idaho

- Tuesday marks the deadline set by EU for Italy to revise its budget

- Chinese industrial production and retail sales data due Wednesday

- Fed Chairman Jerome Powell discusses national and global economic issues with Dallas Fed President Robert Kaplan at an event hosted by the Dallas Fed

- U.S. consumer inflation probably rebounded in October after easing in September. The consumer price index data is projected to show a 0.3 percent increase for the prior month.

- Policy decisions are coming from central banks in Mexico, Philippines, and Thailand

These are the main moves in markets:

Stocks

- Japan’s Topix index fell 0.1 percent at the 3 p.m. close in Tokyo.

- Hong Kong’s Hang Seng Index was little changed.

- Australia’s S&P/ASX 200 Index rose 0.3 percent.

- Shanghai Composite Index rose 0.7 percent.

- S&P 500 Index futures added 0.4 percent. The S&P 500 fell 0.9 percent.

- FTSE 100 index futures gained 0.7 percent.

Currencies

- The yen dipped 0.2 percent to 114.04 per dollar.

- The offshore yuan was steady at 6.9556 per dollar.

- The Bloomberg Dollar Spot Index gained 0.3 percent.

- The euro traded at $1.1309, down 0.2 percent.

- The pound fell 0.6 percent to $1.2896.

Bonds

- The yield on 10-year Treasuries declined about six basis points on Friday to 3.18 percent.

- Australia’s 10-year bond yield fell two basis points to 2.74 percent.

Commodities

- West Texas Intermediate crude climbed 1.1 percent to $60.84 a barrel. It’s dropped about 20 percent from an Oct. 3 peak.

- Gold was steady at $1,208.74 an ounce, after sinking 1.2 percent Friday to hit the weakest in a month.

By Adam Haigh and Andreea Papuc

November 12, 2018, 5:15 PM GMT+11

Source: Bloomberg