-

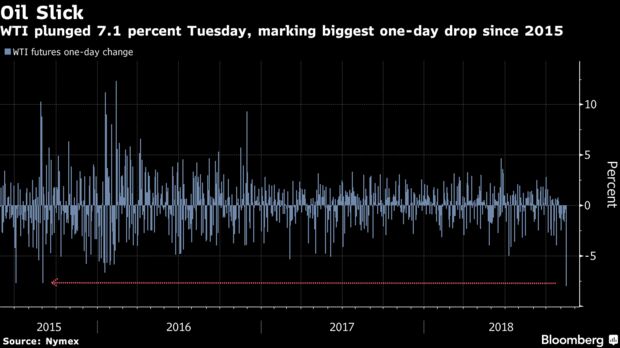

WTI extends retreat toward $55; U.S. equity futures decline

-

Pound, gold flat; Treasuries hold steady; EM shares slip

European stocks dropped on Wednesday, outpacing losses in Asia and U.S. futures as investors weighed the rout in oil prices, a mixed bag of data on China’s economy and the latest trade developments. The dollar and Treasuries were steady.

The pound fluctuated as traders wait to see if Theresa May can persuade colleagues to back her Brexit deal. Treasury yields were flat and the dollar remained near an 18-month high. Italian bonds fell after the government submitted a defiant budget to the European Commission on Tuesday.

The oil rout has arrived at an already challenging time for global equities, which have been digesting a downturn in the tech sector, the ongoing trade spat between the two biggest economies as well as a higher-rate regime. With the Trump administration said to be holding off on imposing new tariffs on automobiles there is ground for some optimism, but Brexit and Italian risks linger, American inflation data is out Wednesday and key reports on the crude market are also imminent.

Focus will also turn to Federal Reserve Chair Jerome Powell, who speaks Wednesday, with some observers expecting him to calm worries about the central bank pushing its interest rate-hike cycle too far. That comes after the latest read on China’s economy, where retail sales missed estimates, though industrial production held up.

Elsewhere, India’s rupee rallied to an almost two-month high and its sovereign bonds advanced as the slump in oil prices deepened, easing investor concerns over the oil-importing nation’s current-account deficit. Emerging-market equities slipped. Gold was steady.

Terminal users can read more in our Markets Live blog.

Coming Up

- Fed’s Powell discusses national and global economic issues with Dallas Fed President Robert Kaplan at an event hosted by the Dallas Fed.

- U.S. consumer inflation probably rebounded in October after easing in September. The consumer price index data is projected to show a 0.3 percent increase from the prior month.

- Theresa May will ask her divided Cabinet ministers to back her Brexit deal or quit at a meeting on Wednesday.

- Policy decisions are coming from central banks in Mexico, Philippines, and Thailand.

These are the main moves in markets:

Stocks

- Futures on the S&P 500 Index decreased 0.3 percent as of 8:09 a.m. London time, hitting the lowest in two weeks with their fifth consecutive decline.

- The Stoxx Europe 600 Index decreased 0.8 percent to the lowest in more than two weeks.

- The U.K.’s FTSE 100 Index declined 0.6 percent to the lowest in almost three weeks.

- Germany’s DAX Index sank 0.8 percent.

- The MSCI Asia Pacific Index fell 0.2 percent to the lowest in two weeks.

- The MSCI Emerging Market Index dipped 0.3 percent, reaching the lowest in two weeks on its fifth straight decline.

Currencies

- The Bloomberg Dollar Spot Index climbed 0.1 percent.

- The euro declined 0.1 percent to $1.128.

- The British pound fell less than 0.05 percent to $1.2972.

- The Japanese yen dipped 0.1 percent to 113.87 per dollar.

Bonds

- The yield on 10-year Treasuries gained less than one basis point to 3.14 percent.

- Germany’s 10-year yield decreased two basis points to 0.39 percent, the lowest in two weeks.

- Britain’s 10-year yield dipped four basis points to 1.484 percent.

- The spread of Italy’s 10-year bonds over Germany’s rose 13 basis points to 3.1698 percentage points to the biggest premium in three weeks.

Commodities

- West Texas Intermediate crude decreased 0.4 percent to $55.47 a barrel, hitting the lowest in 11 months with its 13th straight decline.

- Gold fell 0.1 percent to $1,200.90 an ounce.

By Adam Haigh and Samuel Potter

— With assistance by Sophie Caronello

November 14, 2018, 7:15 PM GMT+11

Source: Bloomberg