-

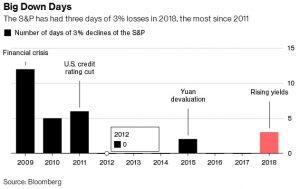

S&P has posted 3 days of 3% drops this year, most since 2011

-

S&P’s 6-day losing streak is the longest since 2016 election

You could write it off as a fluke in February. When it happened again in March, people got concerned. Now stocks are tumbling a third time in 2018, and investors are starting to sense something has changed.

A smattering of 3 percent plunges may not make a bear market, but it sure is a break from the past, which saw only three such ruptures over six years. Selloffs are getting more common — though no easier to withstand. Tech has been bleeding red, Trump is railing at the Fed, and stocks that sat comfortably at record highs just three weeks ago have had just one up day in seven sessions.

For Donald Selkin, chief market strategist at Newbridge Securities in New York, it’s meant four times as many client calls and a bunch of frayed nerves. As one awful session followed another, the range of people asking questions went from clients to friends to family.

“It’s intense. Look at the selloff that happened yesterday afternoon. I was looking at my screen and was like, ’Really?”’ Selkin said. “In February, there was a catalyst to blame. This time, it’s a structural shift.”

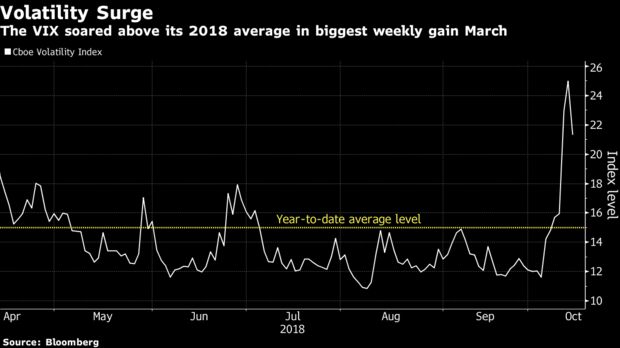

That’s a common view among pros — that while this week wasn’t wholesale carnage, it’s more proof that a new era of volatility is upon us, one that is likely to last. Bad days pile up, and it gets harder to deny that five of the quietest years ever seen in equities are over.

Stocks declined for six straight sessions before rebounding on Friday, the longest streak since before Trump was elected president. Coming after the strongest quarter since 2013, the rout reduced the S&P 500’s yearly advance to 3.5 percent, threatening to make 2018 the worst year since 2015 and the third-worst of the bull market.

Any way you slice it, volatility is rising. This is the first calendar year in seven to feature three single-day 3 percent losses. The Cboe Volatility Index, a benchmark for equity turbulence derived from options prices, has spat out an average reading of 15.2 in 2018, up 37 percent from 2017.

A lot of things are roiling the markets, from Federal Reserve rate hikes and geopolitical tensions with China to a rising expectation of a slowdown in earnings growth that has supported stocks for years. The most pressing problem is probably rising rates: 10-year Treasury yields topped out at almost 3.26 percent this week, the highest in seven years.

Investors are rethinking their plans. Out — again — are tech stocks, with the Nasdaq 100 Index plunging more than 6 percent in September alone. In are things like utilities and consumer staples. An exchange-traded fund tracking gold miners rose 6 percent this week, the most since early 2017.

For Brian Frank, president at Frank Capital Partners, who lists Barrick Gold Corp. among his biggest holdings, it’s meant an onslaught of phone calls this week from clients and lots of thank you notes.

“I gathered my analysts and said, ‘I have been dead for so long, but now the doctors see a heartbeat,”’ Frank said by phone. “There definitely were more people calling this week. It was like, ’Oh, we see now why you’ve been sticking to your strategy for so long.”

In the hedge fund he runs, Frank spent most of the week going short, as a rout in main indexes pushed U.S. stocks beneath their key support levels.

Over at Neuberger Berman, they don’t like to inundate institutional clients with conference calls, saving them for big events like the presidential election and Brexit. This year, there’s been lots of big events. The firm did a call in February and a second when emerging markets tanked a few months later. On Thursday, strategists including Joseph Amato, president and chief investment officer there, thought it was the time for a third.

“When you go through periods like this there’s no question that you’re on edge,” Amato said. “These moves are fast and they feel violent in a figurative sense. Our portfolio managers are obviously staring at their screens all day long.”

The mood at Charles Schwab has been pretty chill — no crazy calls, no panicking investors. If anything, says chief investment strategist Liz Ann Sonders, people don’t seem worried enough. She mentioned an internal email sent by a Schwab employee to the chief executive complaining about the firm’s talking heads sounding too grave in public.

“It was like,‘things are absolutely fantastic, we need to support optimism, that’s what investors need to hear,”’ Sonders said. “It gave me that queasy feeling like I had in January.”

By Elena Popina, Sarah Ponczek, and Vildana Hajric

— With assistance by Richard Richtmyer

October 13, 2018, 8:08 AM GMT+11

Source: Bloomberg