The race is on to try and get through stuff before the summer recess in the US and Europe.

Today’s podcast

Overview: Better days

- Quiet night ahead of key risk events starting from Wednesday

- FX little moved, EUR/USD trades in an 18pip range

- Brent Oil up +1.5% to $63.42 on the back of Iran tensions

- US debt ceiling deal close according to sources – plan to suspend to July 2021

- Aussie House Prices show continued signs of stabilisation

- Coming up: RBA’s Kent, UK’s next PM announced (BoJo likely), IMF forecast update, Earnings season also continues

It was a very quiet start to the week with little in the way of top-tier data. The odds also favour another quiet trading session ahead, with the key risk events not starting until Wednesday (note EZ PMIs and key earnings reports are on Wednesday, ECB is Thursday, and US Q2 GDP is Friday). In terms of FX there has been little movement with most major pairs trading in tight ranges. The USD (DXY) is up 0.2% to 97.29 with EUR -0.1% and USD/YEN +0.2%. The AUD is also little moved -0.1% to 0.7036. GBP is also a touch softer -0.2% to 1.2478 ahead of the new PM being announced today. The lack of movement in EUR is notable with my BNZ colleague Jason Wong noting that EUR has traded in just an 18pip range and if the tight range continues it will be the second narrowest daily range ever (excluding 1 January and Good Friday readings).

Oil prices remain bid with Brent oil +1.5% to $63.42 on the back of continued Iranian tensions. Iran overnight said that it would execute a group of alleged CIA-trained spies that had been arrested earlier in the year. US Secretary of State also announced sanctions on a Chinese oil importer for violating US sanctions on Iran (sanctions are being imposed on the Chinese entity Zhuhai Zhenrong and its CEO). Whether the later has any influence on the US-China trade spat remains to be seen and Chinese press yesterday were noting that face-to-face negotiations could happen soon following goodwill gestures by Beijing over the weekend (proposals to clear imports of US agriculture).

Yields are little moved with US 10yr yields -0.7bps to 2.05%. President Trump continues to jawbone the Fed into aggressive easing, but with little impact on market pricing. Prospective Trump Fed nominee Judy Shelton has also chimed in, backing calls for aggressive easing and arguing for a 50bps rate cut at the July meeting (saying “I would have voted for a 50bps cut at the June meeting”). Markets currently price around 30bps of cuts for the July meeting, that likely reflects a 25bps rate cut being fully priced and a 30bps cut to IOER given the effective fed funds rate has crept higher in recent weeks (EFFR now 2.41%).

European bonds continue to outperform given heightened risks over Brexit with UK 10yr Gilt yields -2.6bps to 0.71% and below the BoE’s Bank Rate of 0.75%. Ahead of the ECB on Thursday, German Bund yields were -2.4bps to -0.35% with markets pricing around a 40% chance of a 10bps rate cut to the deposit rate. There was though some pushback in the press from some ECB sources who argue that the ECB will only likely change guidance on Thursday and wait until the September meeting to cut rates – such pushback likely puts greater focus on the EZ PMIs that are out on Wednesday.

On the US debt ceiling, sources say the White House and Congress are close to nearing a deal which would see the debt ceiling suspended again through to July 2021. Lawmakers are due to go on recess in August with a government shutdown looming by if Congress cannot agree by September 30.

Lastly, Australian House Prices have continued to show their tentative signs of stabilisation. CoreLogic daily house prices show prices in Sydney are up 0.5% since the May 18 election, while Melbourne prices are up 0.4%. The real test will come in the spring when volumes start to pick up, but overall is an encouraging sign that certainty over tax policy, recent cash rate cuts, and APRA’s easing of serviceability requirements is starting to have an effect.

Coming up

Odds favour another quiet day ahead. Domestically RBA Assistant Governor Kent speaks on “The Committed Liquidity Facility” with Q&A at Bloomberg at 8.30am AEST and the usual Weekly Consumer Confidence Index is released (prior 115.8; long-run average 109.5). Japan also has store sales and a final-read on Machine Tool Orders.

Europe sees the UK getting a new PM with the successor to PM May being announced – likely Boris Johnson if we believe the betting markets – and focus will be on whether his policies will match his campaign rhetoric. A formal handover of power will occur on Wednesday. Expect ministerial resignations with the changing of the guard – Chancellor Hammond has already said he will resign as a minister if Johnson is elected. Datawise the Eurozone gets Consumer Confidence

The IMF releases an update to its World Economic Outlook update.

US gets the Richmond Fed Manufacturing Index and Existing Home Sales

Earnings season also continues.

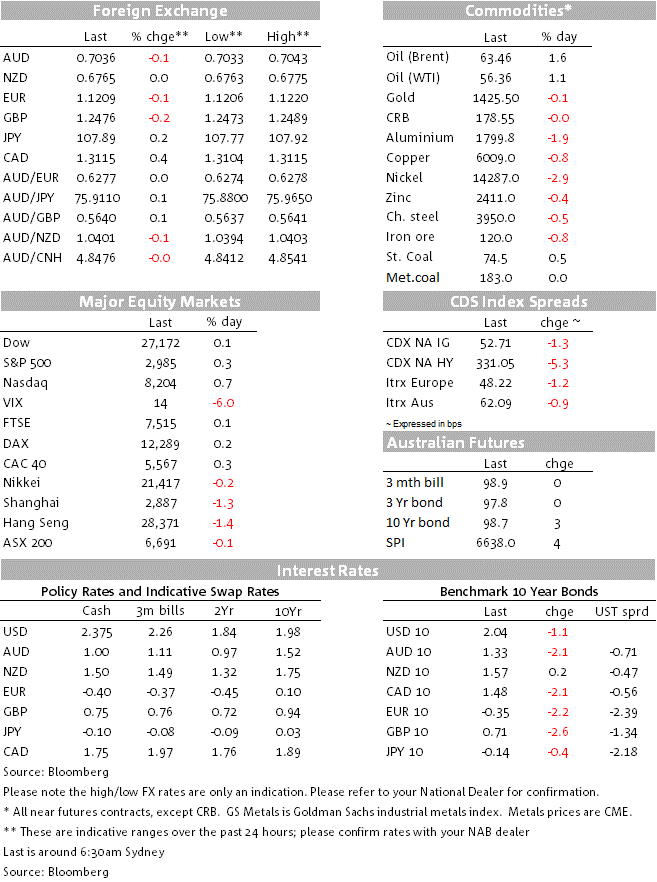

Market prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

23 Jul 2019

Source: NAB