Hopes of a quick resolution to the US China trade dispute seem as unlikely as ever.

Today’s podcast

Overview: All or nothing at all

- President Trump spooks risk assets again saying he doesn’t want a partial trade deal

- Chinese trade delegation cancels US farm visits and heads back home earlier than planned

- Mixed Fed messages – Bullard and Clarida on the dovish side, Rosengren still a hawk

- Trade news hit US equities and UST yield closed lower across the curve – 10y UST -6bps at 1.72%

- AUD ends Friday close to its weekly low and joins NZD as the underperformers for the week

- Merkel’s coalition agrees budget neutral package aimed at protecting the climate

- Increase in Euro shorts the biggest speculative move last week. NZD shorts now at new record

- Week ahead

- Monday brings – EU and US September PMIs, Chicago Fed National Activity Index, Draghi testifies while Fed William, Bullard and Daly on speaking duties, T Bill auctions, Brexit ruling

- Rest of week Highlights- AU RBA Lowe speech; RBNZ on hold; US consumer spending and PCE; CH industrial profits

Why begin, then cry for somethin’ that might have been? No, I’d rather, rather have nothing at all – Frank Sinatra

Markets were cruising along on Friday night with European equities closing the week in positive territory while US equities were treading water. Then President Trump busted the groove telling reporters at the White House that he was not keen on a partial trade deal with China. Unsurprisingly, the Chinese trade delegation had “an adjustment to their agenda” and cancelled their plans to visit US farms. US equities sold off, UST yields rallied across the curve and safe haven currencies went bid. The AUD and NZD were already struggling before the news and in the end closed Friday as the big G10 underperformers for the week.

The hot and then cold and then hot and cold again US-China trade vibes continue to rattle markets. Hopes of a potential interim trade deal had boosted sentiment ahead of last week’s China’s trade delegation visit to the US, but in the end it seems that the inability to find common ground in key contentious issues such as intellectual property rights resulted yet again in an increase in tensions.

Speaking at the White House during a joint press conference with Australian PM Morrison, President Trump sent markets into a tailspin remaking that “I am not looking for a partial deal (with China, my remarks). I am looking for a complete deal,”. Trump then said that he has an “amazing” relationship with Chinese President Xi Jinping but that right now they’re having “a little spat.” Adding that “I think the voters understand that…I don’t think it has any impact on the election.”

Soon after the Chinese trade delegation cancelled a planned visit to farms in Montana and Nebraska – organised as a gesture of goodwill – citing “an adjustment of their agenda” and looked to return to China earlier than planned.

European equities had already closed the week with modest gains ( EU Stoxx 50 +0.56%) before the US-China news hit the screens. Ahead of the news US equities we trading marginally in the green and in the end closed the day between around 0.50% to 0.80% lower.

On a positive note, official statements from both the US and China noted that negotiators had held “productive” and or “constructive” talks while both sides agreed to continue negotiations in October.

Reaction to the news triggered a rally in US Treasuries with yields moving lower across the curve. After staging a 10bpos decline early in the week, 10y UST yields range traded on Thursday and prior to the trade news the benchmark yield looked set closed unchanged on Friday. In the end, yields fell around 6bps across the curve with the 10y note ending the week 17bps lower at 1.72%.

In FX, the US China trade news saw JPY ( +0.43%) and CHF (+0.18%) enjoyed their typical safe haven bid, CHF closed the week at 0.9912 and USD/JPY yet again struggled to sustain a move above ¥108 and close the week at ¥107.56. It now has opened the new week at ¥107.72.

The AUD and NZD were already struggling on Friday with the market seemingly still adjusting to near term RBA rate cut expectations following the dovish minutes on Tuesday and soft labour market report on Thursday. The AUD closed the week at 0.6773 (-0.38%) and NZD at 0.6260 (-0.70%) and both antipodean currencies were the G10- underperformers for the week, down 1.9% and 1.6% respectively.

On Friday, NAB brought forward the timing of forecast rate cuts and now expects 25bp cuts in Oct and Dec, taking the cash rate to 0.5% (previously Nov and Dec timing). The change reflects persistent spare capacity in the labour market, no sign yet that the recent tax cuts are having much effect, and no sign of additional fiscal stimulus in the near term. The longer-term view is unchanged – unless there is meaningful fiscal stimulus the RBA is likely to cut to 0.25% and adopt unconventional policy by mid- 2020. This would initially likely involve a more explicit form of forward guidance and buying government bonds.

CFTC data showed a record NZD net short number of contracts (over 36,000) for the period to 17 September, or around USD2.3b on a net notational basis and Jason Wong , our BNZ market strategist notes that heightened speculative selling has been a key driver of NZD underperformance over recent weeks. This sets the scene for a possible contrarian bounce on any positive NZD news.

EUR and GBP also underperformed on Friday, falling 0.2% to 1.1020 and 0.4% to 1.2480 respectively. Merkel said that Germany will stick to zero deficit spending, ignoring the plea from the ECB to ease fiscal policy. Of note as well, CFTC data revealed a large increase in speculative EUR shorts, contracts have now increased from -38K to -68K since the end of August. Meanwhile on Brexit news, the Irish Foreign Minister put a dampener on the Brexit vibe, saying that while the mood was better, a deal is no nearer.

Friday also included a number of Fed speakers with doves and hawks sticking to their narrative. Boston Fed President Rosengren (Knonw Hawk) said that he dissented from the Fed’s decision to cut rates earlier in the week due to the risk of further inflating the prices of risky assets and encouraging households and firms to take on too much leverage”. He argued that US monetary policy was already accommodative and additional stimulus was not needed.

Meanwhile Fed Bullard ( known Dove) argued that “It is prudent risk management, in my view, to cut the policy rate aggressively now and then later increase it should the downside risks not materialize. At the same time, a 50 basis point cut at this time would help promote a more rapid return of inflation and inflation expectations to target.” Fed Clarida was also on speaking duty and suggested that every meeting is live noting that “Clearly the center of gravity on the committee is the second adjustment was appropriate. Going into October and beyond, we’ll go one meeting at a time.”

On the back of a lot of criticism following the volatility in US money markets, the New York Fed announced a series of overnight and term operations for the next three weeks in order to alleviate pressure into the quarter end. Dynamics in the US money market are likely to remain in focus tonight with the US Treasury Department auctions of $45bn 13-week and $42 bn 26-week bills.

Over the weekend Iran’s president warned that foreign forces are threatening the security of the Gulf, after the US said it was deploying troops to the region. Mr Rouhani also said Iran would present a new Gulf peace initiative at the United Nations on Tuesday.

Coming up

- Monday brings EU and US September PMIs with market looking for a small rebound in the manufacturing sectors. The Chicago Fed National Activity Index is also out while Fed William, Bullard and Daly are on speaking duties. US T Bill auctions and Brexit ruling are also likely to be in focus. Draghi testifies to the European Parliament where he’ll no doubt be talking up the plan for further ECB stimulus but at the same time pleading for some help from fiscal policy

- Highlights for the week include AU RBA Lowe speech; RBNZ on hold; US consumer spending and PCE; CH industrial profits

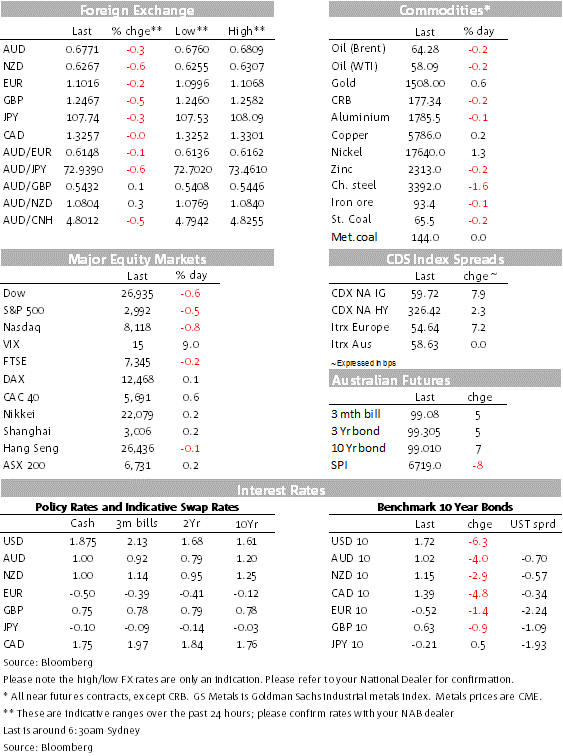

Market prices

23 Sep 2019

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets