UK politics has turned even more toxic with Prime Minister Boris Johnson suspending parliament from September 12, for five weeks.

Today’s podcast

Overview: On a [Brexit] night like this

- UK prorogues (suspends) Parliament – limiting time for Parliament to oppose a no-deal Brexit

- GBP plunges, though pares losses to -0.7% to 1.2215; EUR/GBP +0.5%; AUD/GBP +0.5%

- US 30yr yield hit a record low of 1.90% before reversing as Mnuchin states “ultra-long bonds under very serious consideration”

- European bonds rally hard with Italy closer to a government; 10yr BTP yields -9.4bps to 1.039%

- No significant trade headlines – note China likely quiet as it prepares for the Oct 1st 70thanniversary of the PRC

- Coming up today: AU Capex, NZ ANZ Biz Survey, German UR/CPI, US Q2 GDP-revisions

The UK plunged closer to a constitutional crisis overnight with PM Johnson proroguing parliament for five weeks starting from September 9-12 to October 14, effectively suspending parliament in the lead up to the October 31 Brexit date. The move limits the amount of time that the Parliament has to oppose any no-deal Brexit with the Speaker of the Commons Bercow describing it as a “constitutional outrage”. GBP plunged -1.0% initially, but did pare some of the losses to be -0.7% to 1.2215. It is possible that the bold move will force opposition parties and pro-remain Tory MPs to finally unite around a strategy to oppose a no-deal Brexit – or in the words of Kylie Minogue – On a night like this I want to stay forever. Betting odds currently place a no-deal Brexit at 44%, while an exit with or without a deal at 52%.

There hasn’t been much contagion to other risk assets with Equities mostly higher (S&P500 +0.6% to 2,887). The USD (DXY) is +0.2% to 98.247, while the AUD is ‑0.3% to 0.6734 with much of that weakness coming after yesterday’s weak construction figures. The global bond rally continues unabated, though just your scribe is about to hit send US Treasury Secretary Mnuchin states ultra-long-bonds are under very serious consideration. The outperformer remains Italian debt with 10yr BTP yields -9.4bps to 1.039% with Italy closer to a new coalition government, while UK 10yr Gilt yields fell -5.9bps to near record lows at 0.439% as Brexit fears bite.

First to the UK in detail. Your scribe is probably not the only analyst scrambling to find their dictionary this morning. The word of the day is Prorogue: a verb meaning to discontinue a session of Parliament without dissolving it. The Queen overnight granted permission for the government to suspend parliament between the 9-12th of September and the 14th of September October. While the move was officially dressed as an opportunity to introduce a new Queen’s Speech to set out the government’s legislative agenda, it effectively reduces the time Parliament has to discuss and avoid a no-deal Brexit ahead of the October 31 Brexit deadline and gives little room for Parliament to instruct the PM ahead of the October 17-18 EU summit. For trivia buffs the proroguing would be the longest suspension since 1945, while the current session of Parliament is the longest in almost 400 years.

The UK Parliament is due to sit next Tuesday (September 3) and opposition parties have said they will do everything they can to prevent this course of action. To date co-ordination between opposition parties and pro-remain Tory MPs has been lacking and centred around legislation, but this moves could see them coalesce around a more radical form of action such as a no-confidence vote (note the government only has a 1 seat majority in Parliament). Tory MP Grieve noted “I think it’s going to be very difficult for people like myself to keep confidence in the government and I can well see why the leader of the opposition would wish to table a motion of no confidence”. Whether opposition parties try the legislative route, or try and bring down the government via a no-confidence vote remains to be seen. It will be a very intense couple of weeks and volatile for GBP.

Outside of the UK there was little to report. On trade there was no new headlines of significance. We shouldn’t expect much though in the following month as China’s focus turns to its celebrations for the October 1st 70th anniversary of the founding of the People’s Republic of China (PRC). Reports suggest Beijing is already going in lockdown, while it is likely factories in and around Beijing will suspend production to ensure blue skies in the leading up to the day. The later will be important in interpreting Chinese economic data for September, including for industrial production and the PMI.

Stocks liked the quiet with the S&P500 +0.6% to 2,887. Stocks were boosted by gains in the energy sector (+1.4%) on the back of higher oil prices (WTI +1.8% to $55.91) with the IEA reporting a large decline in oil inventories – IEA reported inventories fell by 10m barrels last week compared to expectations of a 2.1m decrease.

Bonds have largely continued their rally with Brexit headlines and more positive Italian political development seeing European bonds rally sharply. Brexit fears saw German 10yr Bunds fall -2.1bps to -0.71%, while UK 10yr Gilts fell -6.0bps to 0.44%. Meanwhile in Italy the leaders of the populist Five Star and centre-left Democratic Party have agreed to form a government with Italian 10yr BTPs -9.4bps to 1.039%.

Yesterday weak Australian construction figures weighed on the Aussie, with AUD -0.3% to 0.6734. Total construction work down fell -3.8% against a consensus of -1.0% with sharp falls in both residential construction and non-residential building. The figures present downside risks to next week’s GDP figures and also suggests the RBA will be disappointed with their latest SoMP implying a Q2 GDP forecast of 0.8% – NAB is pencilling in 0.5% with downside risk.

Across the ditch, the NZD underperformed for no obvious reason with NZD -0.4% to 0.6338. There was an opinion piece by RBNZ Governor Orr that mostly reiterated his previous comments. Other FX moves were more moderate with the USD (DXY) +0.2%, driven by weakness in GBP (-0.7 to 1.2213) and slight weakness in EUR (-0.2% to 1.1080) and Yen (USD/JPY +0.3% to 106.04).

Coming up today

Focus this morning will be on the Australian Capex figures and whether investment is slowing more sharply than expected and whether global uncertainty is starting to weigh on firms investment plans. Otherwise it is a fairly quiet day ahead for data:

- AU Capex and Expected Capex (11.30am AEST): Q2 expenditure is expected to be +0.4% q/q where risks are to the downside. NAB forecasts a more subdued -1.0% q/q outcome and it is worth noting that yesterday’s private non-residential construction fell more sharply than expected at -4.4% q/q. The Machinery and Equipment component out of this survey is also used by the ABS in compiling the GDP figures which are out next week. Focus will also be on the expectations for 2019/20 spend and whether global uncertainty is weighing on firms investment plans – the consensus look for a $113bn print. The potential for global uncertainty to weigh on hiring and investment decisions is worrying policymakers worldwide, including at Martin Place.

- NZ ANZ Business Survey (1.00pm local, 11.00am AEST): August’s ANZ Business Survey will be watched closely to see whether recent rate cuts have boosted sentiment – my BNZ colleagues are doubtful. No consensus is available but last month the outlook was +5 and well below its long-run average of 26.9, while confidence was -44.3 and well below the long-run average of +8.6.

- BoJ’s Suzuki speaks (10.30am local, 11.30am AEST):

- German CPI and Unemployment (2.00pm local; 10.00pm AEST): Greater than usual focus on the unemployment figures given the deterioration seen in hiring intentions within the IFO survey. Consensus looks for an unchanged Unemployment Claims Rate of 5.0%, while the August flash Headline Harmonized CPI is expected to be 1.2% y/y.

- EZ Confidence Indicators (11.00am local, 7.00pm AEST):

- US Q2 GDP-revised (8.30am local, 10.30pm AEST): Q2 GDP is expected to revised marginally lower to 2.0% quarterly annualised from an initially reported 2.1%.

- US Trade Balance (8.30am local, 10.30pm AEST): The July Goods Trade Balance is expected to be little changed from last month at -$74.4bn. Expect focus on US-China goods trade, though with likely little market impact.

- US Jobless Claims (8.30am local, 10.30pm AEST): Jobless claims are expected to remain low at 214k, up slightly from last week’s 209k.

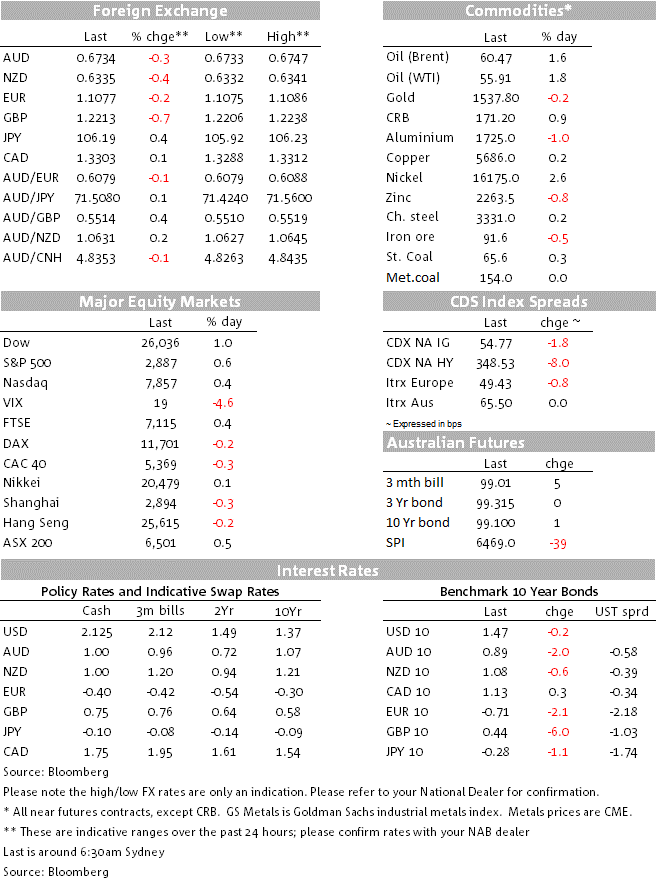

Market prices

29 Aug 2019

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets