Markets continued in risk-off mood as China announced its response to President Trump’s threat of extended import tariffs.

Today’s podcast

Overview: Crumblin’ down

- PBoC allowance for a weaker CNY sends markets into a tailspin with news of a halt in imports of US agricultural products not helping either

- Trump accuses China of currency manipulation and calls on Fed to do more

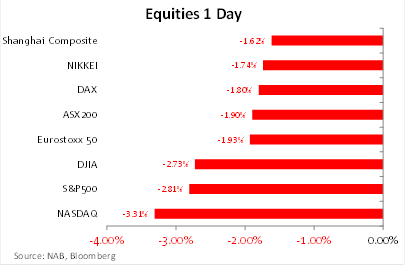

- Equity markets fall sharply with the US leading the way

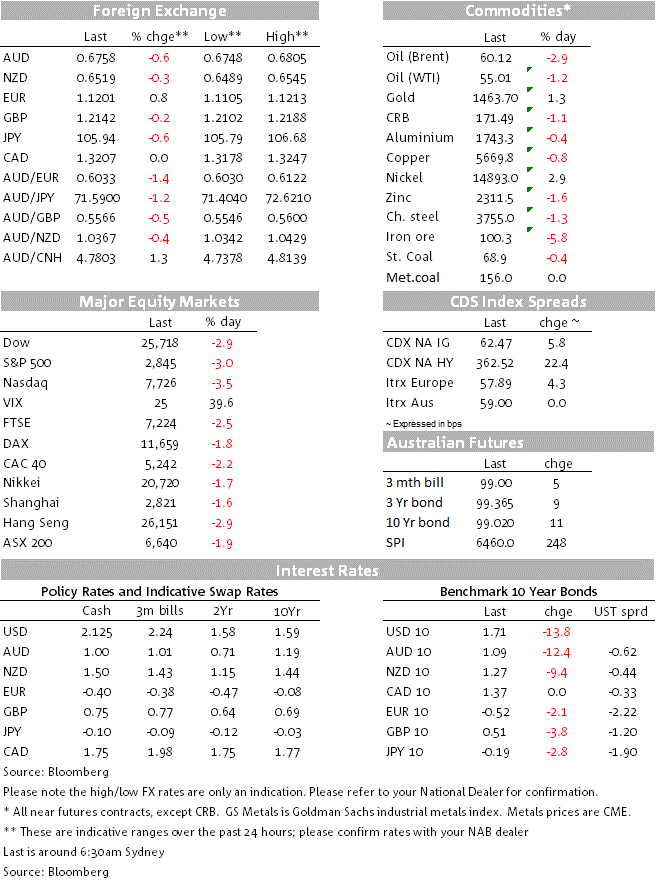

- Core yields gap lower with 10y UST down 11bps to 1.7362%

- USD weighed down by safe haven bid/closing of carry trades on EUR, CHF and JPY

- AUD “recovers” to 0.6756, after trading down to 0.6748 post yesterday’s CNY fix. NZD shows some resilience at 0.6528

- NZ labour market data and RBA policy meeting today’s highlights

You can bend me, you can break me, But you better stand clear When the walls come tumblin’ down, When the walls come crumblin’ crumblin’,When the walls come tumblin’ tumblin’ down – John Mellencamp

After last week’s announcement by President Trump to impose a 10% tariff on the remaining $300bn Chinese imports not currently subject to tariffs come September 1st, alongside the threat of lifting the tariff rate up to 25% we didn’t have to wait long for a retaliation from China. Yesterday the PBoC allowed for a sharp depreciation of the yuan sending risk assets into tailspin. Equity markets have fallen sharply with the US leading the way and we have also seen solid buying across core global bonds. Moves in currencies have been somewhat mixed with the USD weighed down by a safe haven bid/closing of carry trades on EUR, CHF and JPY while EM FX is broadly weaker dragging the AUD lower and NZD to a lesser extent. Commodities were also broadly weaker as the market reassess the global growth outlook with gold the one exception, up 1%. Not helping sentiment, in a series of tweets, President Trump has accused China of currency manipulation and calls on Fed to do more.

After last week’s tariff announcement by President Trump, the market was expecting a reaction from China, but based on a recent behaviour there was still some expectation for China to take its time while also aim for a more measured response. In the end we got a little bit more than anticipated, yesterday the PBoC set the CNY fix at 6.9225, above expectations, and above the previous tough to break 6.9000 level that the Bank seemed cautious not to breach previously. Reaction to the fix saw USD/CNH jump from 6.98 to as high as 7.11 in 15 minutes. CNH move may have been amplified by the HK situation with protesters encouraging a general strike and shutting down parts of the city, thus adding another dimension to risks overhanging markets. China’s patience towards the pro-democracy protesters is no doubt wearing thin and threatens to escalate into a civil war

After the fix the onshore USD/CNY market leaped from 6.94 close last week to 7.02 very quickly closing the day at 7.05. The facts that USD/CNY traded up through 7.00 without obvious official resistance alongside the second biggest daily decline in offshore CNY against the USD are very telling in our opinion. We think it sends a signal that China is a gearing up a long trade battle with the US, consistent with President Xi ‘s recent remarks that ““Now there is a new Long March, and we should make a new start”. Allowing for yuan depreciation is an offsetting force against the economic impact from US tariffs, but this action does come at a cost. For one as we have seen overnight, the sharp depreciation of the yuan has triggered a sharp sell off across risk assets, including China’s equity market, heightening concerns over China’s capital outflows and its destabilising impact on the economy. President Trump also didn’t waste too much time hitting his tweeter account accusing China of currency manipulation while also calling on Fed to do more.

Recent events suggest a US-China trade deal is unlikely to be reach any time soon and indeed it seems reasonable to expect trade tension to get worse before they get better. Yesterday we publish a note (see attached) noting that the prospects for a Sino-US trade deal before next year’s Presidential elections have significantly diminished, with implications for global growth and the degree of policy easing likely from the Fed, et al. Assuming Trump does not row back from new tariffs starting Sept 1, lower AUD and NZD forecast are warranted. We will be writing more on this over the coming days.

Adding to trade war tensions, not long after CNY breached the 7 mark, Bloomberg reported that the Chinese government has asked its state-owned enterprises to suspend imports of US agricultural products after Trump ratcheted up trade tensions last week. China’s state-run agricultural firms have now stopped buying American farm goods, and are waiting to see how trade talks progress.

Amidst the “cracking of 7”, a PBoC spokesman gave an interview with the FT to offer some perspective and last night PBoC Governor Yi issued a statement on the RMB exchange rate that reiterated that message. He said that China will remain committed to the market-based exchange rate regime and refrain from competitive devaluations. He recognised the changed market expectations “amid new developments in the global economy and trade frictions” and reiterated that the Bank would keep the RMB exchange rate “basically stable at an equilibrium and adaptive level”.

The fact the PBoC was quick to approach the FT suggest the Bank is conscious of not creating too much market instability, but at the same time it has opened to door for the market to test its ability to keep the yuan stable. Barring any reversal in latest trade developments USD/CNY and USD/CNH will likely both hold above 7.0 in the coming weeks and we would expect the PBoC to limit momentum towards the next key resistance levels of 7.10/7.15.

As noted above, Trump has fired off a barrage of four tweets overnight directed at China with one of them being “China dropped the price of their currency to an almost a historic low. It’s called “currency manipulation.” Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!”. Interestingly all four tweets mention the words “currency manipulation”, a not-so-subtle signal that he wants the US Fed (or Treasury) to intervene to weaken the US dollar. Trump has previously said he hasn’t ruled out currency intervention, while his economic advisor Kudlow, as recently as Friday, said that there were no plans for intervention. A unilateral intervention – without the support of other major central banks like the ECB and BoJ – would prove to be futile, with an impact on the day from shock value, but likely little sustained impact. Ironically, the PBoC has been manipulating its exchange rate over recent years but it has been to contain weakness and prevent capital flight, than trying to weaken the yuan.

Looking at the overnight market price action, all major global equity indices have ended in the red with US indices leading the decline (see chart below -NASDAQ -3.31%, S&P500 -2.81%) . Overnight price action suggests APAC equity markets are in a for a rough open today.

Unsurprisingly, core global bonds have had a very strong night with sharp decline in yields seen across the board. US. Market expectations of easier Fed policy have ramped up, with the Fed Funds rate currently priced at a low of 1.03%, so that’s at least four cuts, with half a chance of five further rate cuts by the end of next year – the market taking a clear view that the so-called “insurance” easing will morph into a full-scale easing required to ward off a US economic recession. Ramped-up easing expectations have seen a steepening of the yield curve, with the 2-year rate down 13bps to 1.58% and the 10-year rate down by “only” 11bps to 1.74%.

In currency markets EUR,CHF and JPY have outperformed the USD, reflecting a classic safe haven bid given their respective countries massive net positive international investment position. This time around one could also argue that the closing of carry trades has also played a role with all three currencies, especially the Euro, seen as the preferred funding currencies at the moment. EUR now trades back above 1.12 (+0.78%) and CHF is also up by a similar amount (currently at 0.9735).

True to form, yesterday the AUD fell sharply as the CNY breached the mystical 7 mark, recording an intraday low of 0.7648, the aussie went up and down overnight and now trades at 0.6756 and still looking vulnerable to the downside. Showing some resilience NZD trades this morning at 0.6528,only down 0.12% over the past 24 hours. How far and how fast USD/CNY moves above 7.00 will be a key determinant of how far AUD and NZD fortunes over the coming days and weeks. The CNY fix today is again going to be a major focus for the AUD, NZD and FX markets in general today.

Economic data releases are only a secondary consideration for the market at present, while it assesses the likely future damage from the worsening trade war. The US non-manufacturing ISM index fell by more than expected to a near 3-year low, consistent with the slowing in the US economy seen in other indicators. The UK services PMI recovered compared to expectations of a flat result, but remains below average and consistent with sluggish growth.

Melt down

Coming up

- NZ Labour Market data and inflation expectations today, dairy auction early tomorrow

Our BNZ colleagues think the labour data will suggest the trough in New Zealand’s unemployment rate is now behind us. BNZ is forecasting an unemployment rate of 4.3%, up from Q1’s 4.2% and the low of 4.0% in Q3 2018. They also expect employment growth of 0.3% in the quarter, which will leave the level of employment barely changed over the last nine months. The Labour Cost Index is seen printing at 2.1% over the year to June 2019.

- AU ANZ Job ads, RBA policy meeting

We expect the RBA to stand pat today and hold the cash rate steady at 1%, following two consecutive rate cuts in June and July. Our economists anticipate the post meeting statement should again signal a willingness to cut further if required, repeating that, “the board will continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time (emphasis added)”. The statement should also highlight the ongoing trade conflict between the US and China.

Beyond August, NAB’s view is that the Reserve Bank will cut again by November, with the government likely to announce additional fiscal stimulus late this year. Depending on the effectiveness of lower rates and fiscal stimulus, alternative monetary measures are possible next year.

- Germany Factory Orders (0.8% vs. -2.1% prev.)

- Fed’s Bullard speaks on US economy

Market prices

6 Aug 2019

About the Author

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets