FOMC triggered reactionary moves across many FX pairs but today’s economic data line-up conjures thoughts of ‘from the fry pan to the fire‘. There is a lot of data to monitor with AUD Employment, the SNB and BoE rate updates (CHF & GBP), GBP Retail Sales, EUR Trade Balance, USD Weekly Unemployment Claims and then a BoE Gov Carney speech. NZD GDP has been and gone without too much change as yet. Some trend line breakout moves have triggered although they have been few and short lived; the minefield of data is not conducive to developing long, smooth-trending markets moves.

USDX weekly: there is still a bearish candle for now but watch to see if this changes once the FOMC dust settles:

Trend line breakouts:

AUD/USD: The Aussie has broken up through a 4 1/2 bear trend line but FOMC triggered a pullback here to test this region. The bullish component of this move started in yesterday’s Asian session as the 15 minutes charts reveal. A scalp-style TC trade could have been productive here prior to FOMC. Watch this major trend line for any make or break today with AUD Employment data:

AUD/USD 4hr:

AUD/USD 15 min: just after a new TC LONG signal triggered:

AUD/USD 15 min: this gave a decent R/R trade prior to FOMC of 6R:

NZD/USD: The Kiwi has held above the broken 3-year bear trend line and rallied further in the lead up to FOMC. The bullish component of yesterday’s move also started in the Asian session as the 15 minutes charts reveal. A scalp-style TC trade could have been productive here prior to FOMC also:

NZD/USD 4hr:

NZD/USD 15 min: after the new TC signal during the Asian session:

NZD/USD 15 min: a great R/R trade here using TC off 15 min chart prior to FOMC for 6R:

AUD/JPY: this might be starting a breakout move and the bullish component of this move started in yesterday’s Asian session too. A scalp-style TC trade could have been productive here prior to FOMC as well:

AUD/JPY 4hr:

AUD/JPY 15 min: a new TC triggered here yesterday:

AUD/JPY 15 min: this gave a good R/R trade:

ASX-200 4hr: the ASX-200 broke up through the 5,800 for a 145 point move from the wedge breakout but has pulled back to test this region. Watch for any new make or break from this level:

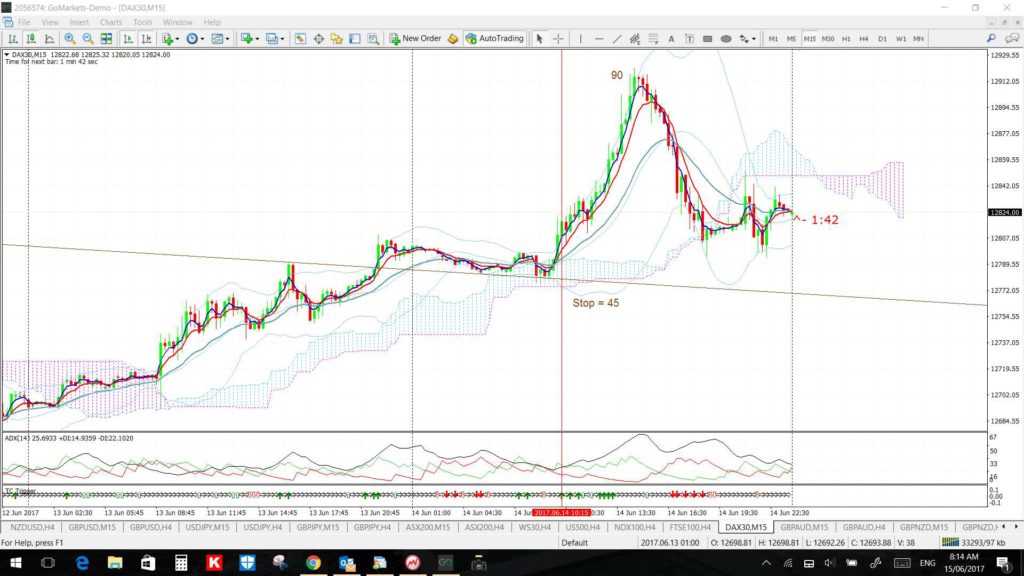

DAX-30: this has eventually given 130 points in a breakout move that also could have been caught on the 15 min chart using TC Trigger:

Dax 4hr:

Dax 15 min: a great TC signal after the trend line breakout for 90 points:

USD/TRY: this looks to be trying to break down from a long term wedge pattern. The 15 min chart gave a new TC signal but needed a large Stop. However, the R/R ended up being worthwhile:

USD/TRY 4hr: breakout starting?

USD/TRY 15 min: R/R ended up being ok off the 15 min TC Short signal:

Other Forex:

EUR/USD 4hr: choppy with FOMC but no 15 min decent TC signals:

EUR/JPY 4hr: might be one to watch tomorrow with the Friday BoJ rate update.

GBP/USD 4hr: watch with today’s BoE rate update and GBP Retail Sales data:

USD/JPY 4hr: watching to see if there is any follow-through of this trend line break. Might not do too much though until tomorrow’s BoJ rate update:

GBP/JPY 4hr: watch today with GBP data and tomorrow with the BoJ:

GBP/AUD 4hr: watch today with GBP and AUD data:

GBP/NZD 4hr:

EUR/AUD 4hr:

EUR/NZD 4hr:

USD/MXN 4hr: FOMC didn’t stop the slide here, not yet at least:

USD/CNH 4hr:

Commodities:

Gold 4hr: choppy with no TC 15 min opportunity:

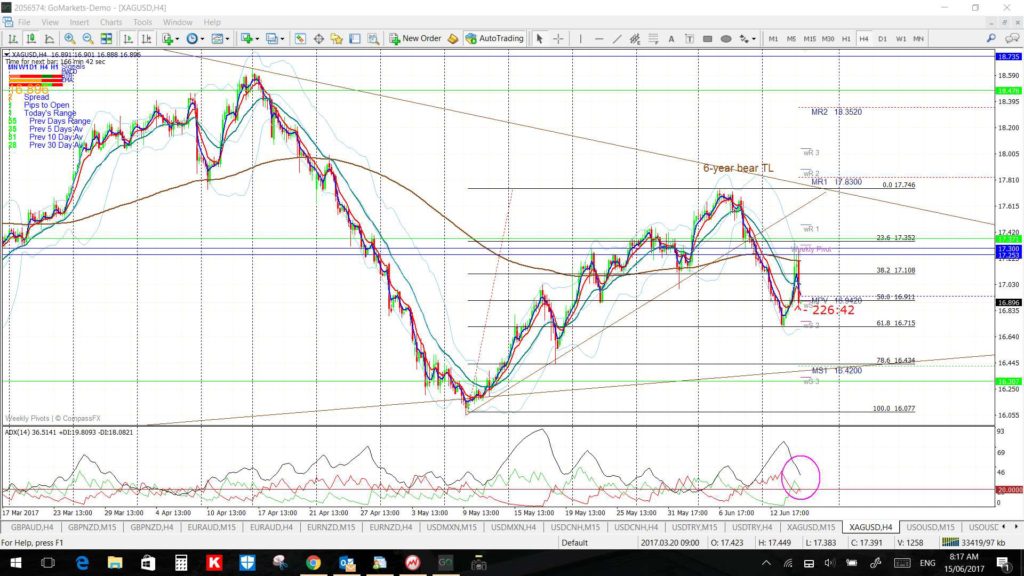

Silver 4hr: choppy here too and note the revised trend lines:

Oil: weaker after Crude stockpile data but the move was too quick for even the 15 min chart. Watch this bottom trend line though as it has been in play for 16 months and may not be given up too easily:

Oil 4hr:

Oil 15 min: