The US holiday Monday seems to have kept FX a bit quiet with just a bit of drift seen on many pairs. The US$ is a bit weaker which has helped to trigger two new small breakouts. One important point to note though is that the Aussie has punched up through a 4 1/2 year bear trend line so watch for any new hold above this level. Data today includes GBP CPI.

USDX weekly: lower to start the week and I’m watching for any Bear Flag follow-through:

EURX weekly: watching for any Bull Flag to get going here:

Trend line breakouts and TC signals:

NZD/USD 4hr: a small breakout but watch for any new make or break at the 0.73 S/R level:

USD/JPY 4hr: a small breakdown here:

Gold 4hr: still going at 180 pips:

EUR/USD 4hr: I’d suggested on the w/e this might target the monthly 200 EMA and that is where price is currently parked so watch this region for any new make or break:

GBP/USD 4hr: now at 250 pips. Watch for any impact from today’s GBP CPI data:

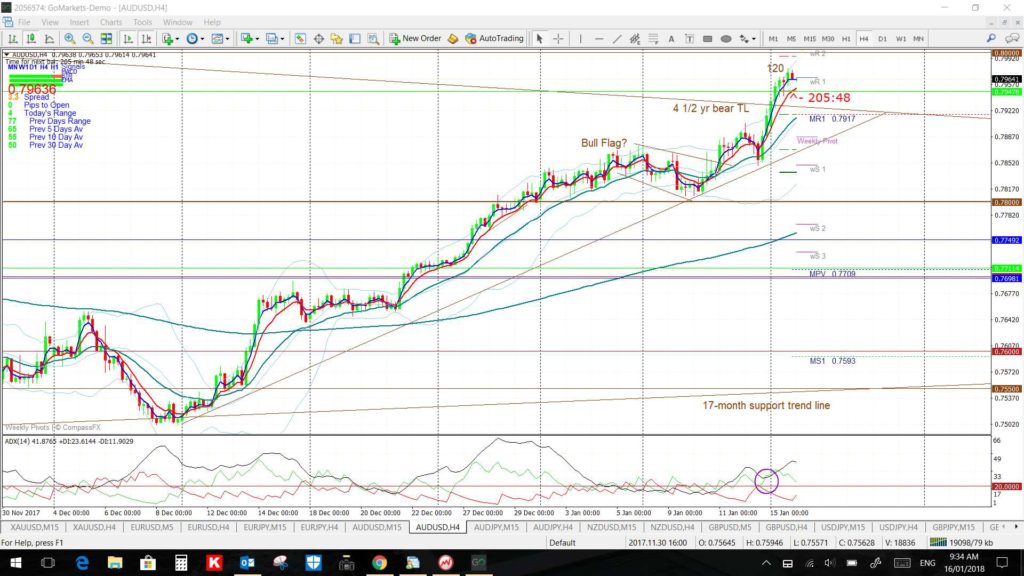

AUD/USD: this 4hr chart breakout is now at 120 pips BUT, more significantly, price action has broken up through a 4 1/2 year bear trend line and is resting just under the major 0.80 level. This is HUGE S/R zone for this pair as the monthly chart below reveals. This is the next zone to watch for any new make or break. US$ weakness and Commodity strength is the perfect storm here to help underpin bullish sentiment on the Aussie:

A/U 4hr: watch the 0.80 for any new make or break:

A/U daily: 0.80 is in focus now:

A/U weekly: watch for any weekly trend line breakout here:

A/U monthly: note the huge S/R impact at the key 0.80 level.

Other Forex: watch for any momentum-based trend line breakouts:

EUR/JPY 4hr:

AUD/JPY 4hr:

GBP/JPY 4hr:

Oil 4hr:

BTC/USD daily: