I had mentioned in my weekend analysis that the Cross pairs might be the go-to currencies to trade whilst the US$ chopped around and how true that was! Well, for Monday at least. Some positive Brexit sentiment helped to boost the GBP which, in turn, delivered some decent moves on the GBP-cross pairs.

Data: watch today for impact from the AUD Monetary Policy Meeting Minutes, GBP CPI and PPI, EUR ZEW Economic Sentiment and the G-20 Meetings.

USDX daily: weaker on the day and probably due to the combined impact of the higher GBP and EUR and concern over the Trump Twitter tirade.

FX Indices: The FX Indices remain in their daily Ichimoku Cloud and such periods are referred to as FX Index Divergence. The implicationsof this mean that FX trading is better off the shorter time frame charts and during the European or US sessions.

Trend line breakouts and TC signals:

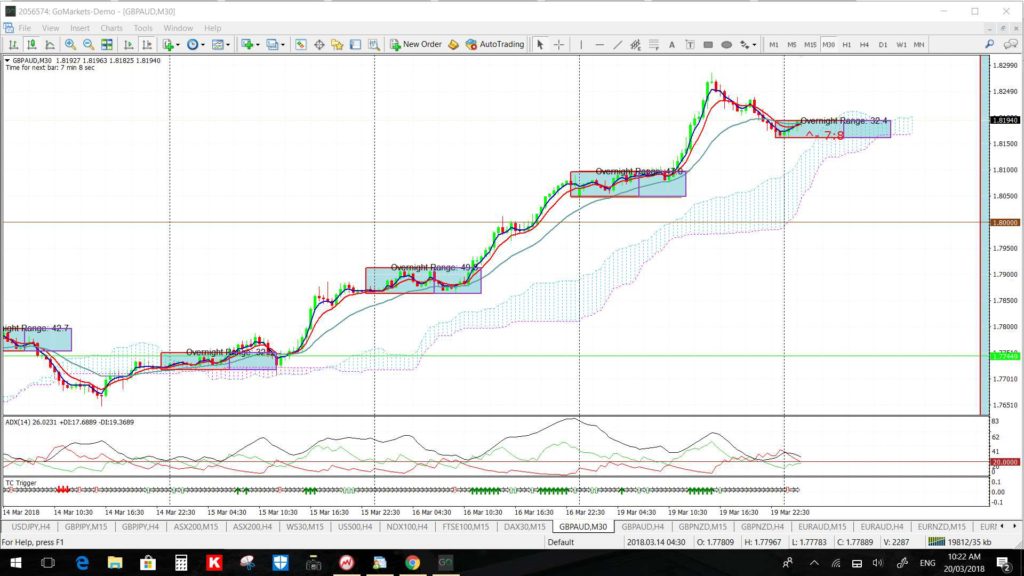

GBP/AUD: the 1.80 level has been the one to watch here over recent weeks and this was broken late last week. Monday’s positive Brexit-related news boosted the GBP and kept this pair running higher; a move which was able to captured using TC after price broke out from the Asian session trading channel.

GBP/AUD 4hr: has rallied 280 pips since breaking above the key 1.80 level:

GBP/AUD 30 min: note how price trades sideways in a narrow range during the Asian and early European sessions (Blue box). Applying TC after a breakout from this trading channel can offer successful momentum trading as it did in this instance:

GBP/AUD 5 min: The Asian trading channel is drawn in on this 5 min chart. Taking the first valid TC signal after a breakout from the trading channel offered a 170 pip trade here worth up to 6.5 R. NB: there was no valid TC signal on the 15 min chart hence the dropping down to the 5 min chart.

GBP/NZD 4hr: this is now 280 pips higher after the trend line breakout from late last week:

GBP/USD 4hr: a sharp move higher once the upbeat Brexit-related news was released. This move was too fast and so did not produce any valid TC signal on the 15 or 5 min chart:

EUR/AUD: the end of last week and start of this week have been better for the FX Cross pairs and the EUR/AUD is an example of this. Sadly, I missed picking up the great low-risk TC signal that triggered here last Thursday.

EUR/AUD 4hr: price is at the 1.60 level now so watch for any make or break from there:

EUR/AUD 15 min: this chart shows how there was a low-risk TC signal that triggered last Thursday that is still open and now up 300 pips or 10 R:

Other Forex: The US$-based pairs were a bit choppy with the shifting sentiment following concern generated by the weekend Trump tweets. Also, major S/R levels remain in play and are worth keeping in mind.

Gold 4hr: still ranging in a triangle:

EUR/USD 4hr: ditto. The EUR traded higher against the US$ on the ECB rate discussion news.

EUR/JPY 4hr: there is decent support from the 130 region and monthly 200 EMA so caution is needed whilst price hangs around here:

AUD/USD 4hr: the 0.77 is holding for now but, also, there is strong support just below from the 17-month support trend line.

AUD/JPY 4hr: messy and note the declining momentum:

NZD/USD 4hr: the 0.72 is holding here for now:

USD/JPY 4hr: getting very tight here now!

GBP/JPY 4hr: messy so I’ve revised the trend lines here:

EUR/NZD 4hr: getting close to the triangle trend line so watch for any new breakout:

Oil 4hr: still triangle bound:

BTC/USD daily: ditto here and also holding above $8,000 S/R: