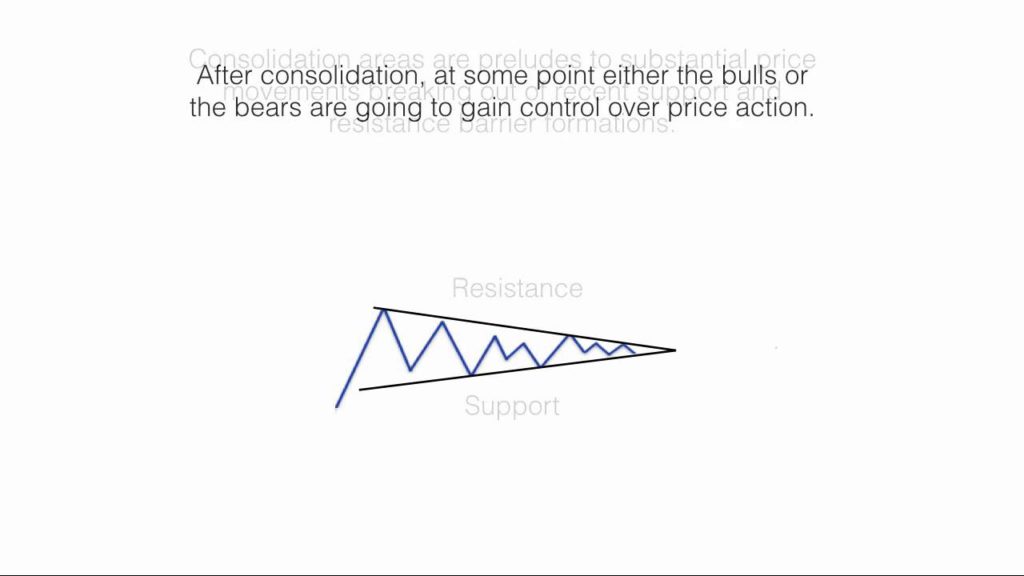

I’m back from holidays and just getting back into my normal groove. Checking the FX charts gives me an overall impression that many pairs are in a holding pattern of sorts and consolidating either near major S/R or at significant Fibonacci levels. The same drill applies: watch for any momentum-based trend line breakout.

Data: Watch today for CNY Manufacturing and Non-Manufacturing PMIs, the BoJ interest rate update and US Consumer Confidence data. There is EUR CPI and other second tier data to watch for impact as well.

USDX daily: struggling at the daily 200 EMA and 95.50 resistance level. Watch these for any new make or break:

USDX weekly: still a possible Bear Flag here BUT if price continues higher then watch the 100 level for any test:

EURX weekly: a revised Flag here BUT still a possibility for the Bull Flag for the time being:

FOREX:

Gold daily: consolidating within a triangle and near the daily 61.8% fib:

EUR/USD daily: consolidating within a Flag and above 1.15 major S/R:

EUR/JPY daily: consolidating under major 134 S/R:

AUD/USD daily: consolidating within a Channel and above the daily 61.8% fib:

AUD/JPY daily: consolidating above a long-term support trend line and below 89 and 87 major S/R:

NZD/USD daily: still below support but watch for any ‘Double Bottom’ bounce activity:

GBP/USD daily: consolidating within a triangle and above the 61.8% fib:

USD/JPY daily: consolidating within a weekly triangle and below 114.50 S/R. Watch the 114.50 today with the BoJ update:

GBP/JPY daily: consolidating within a Flag and near 150 major S/R: