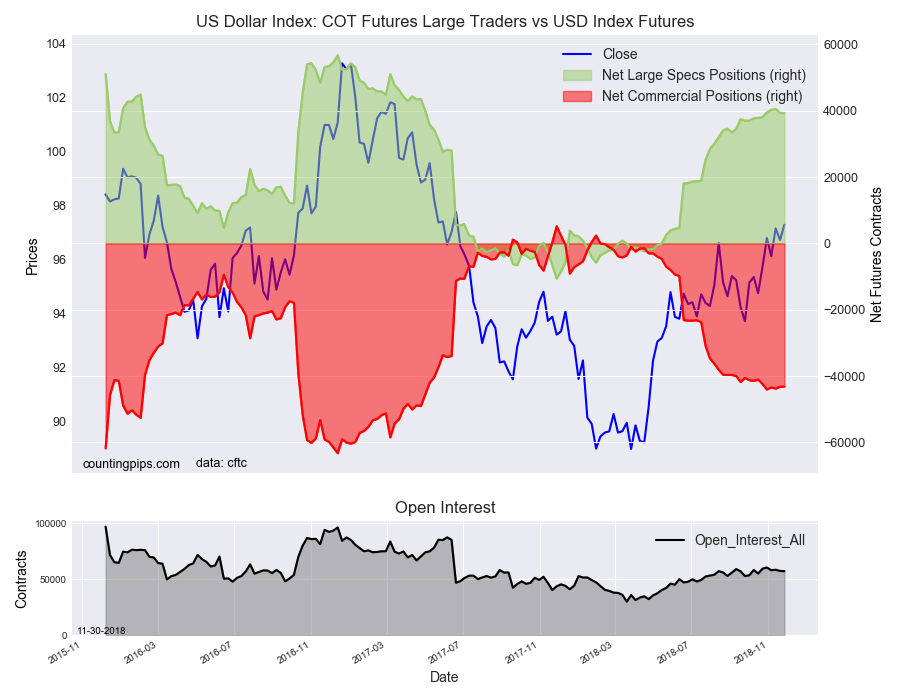

US Dollar Index Speculator Positions

Large currency speculators cut back on their bullish bets in the US Dollar Index futures markets this week while specs also upped their bearish bets in the euro currency, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 39,307 contracts in the data reported through Tuesday November 27th. This was a weekly fall of -33 contracts from the previous week which had a total of 39,340 net contracts.

This week’s net position was the result of the gross bullish position increasing by 611 contracts to a weekly total of 46,349 contracts which was more than offset by the gross bearish position that saw a rise by 644 contracts for the week to a total of 7,042 contracts.

The USD Index net position fell for a second straight week following gains in the previous seven weeks that brought the USD Index standing to the highest level since April of 2017.

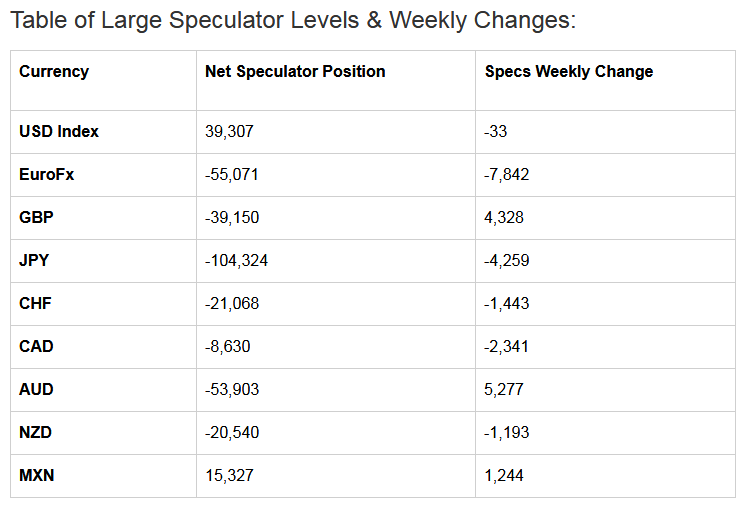

Individual Currencies Data this week:

In the other major currency contracts data, improvements for the week were seen in the British pound sterling (4,328 weekly change in contracts), Australian dollar (5,277 contracts) and the Mexican peso (1,244 contracts).

Meanwhile, the currencies whose speculative bets declined this week were theUS dollar index (-33 weekly change in contracts), euro (-7,842 contracts), Japanese yen (-4,259 contracts), Swiss franc (-1,443 contracts), Canadian dollar (-2,341 contracts) and the New Zealand dollar (-1,193 contracts).

Notable for the week:

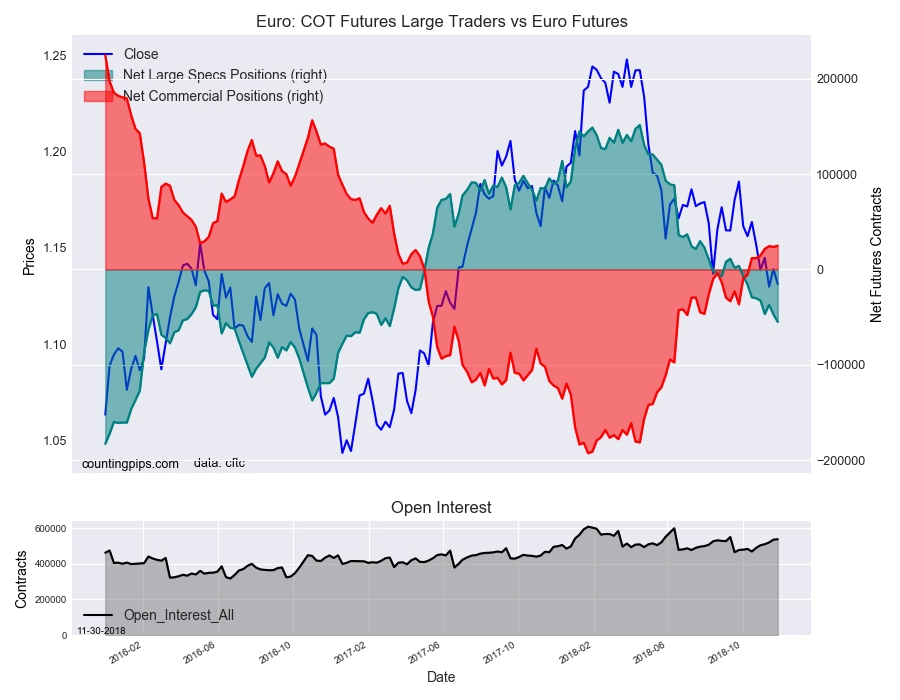

Euro contracts continued to go more bearish with a rise of over -7,000 contracts this week following a -10,210 contract change last week. The current standing for euro spec positions is now at the most bearish level since March 7th of 2017 when the net position totaled -59,501 contracts.

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week resulted in a net position of -55,071 contracts in the data reported through Tuesday. This was a weekly change of -7,842 contracts from the previous week which had a total of -47,229 net contracts.

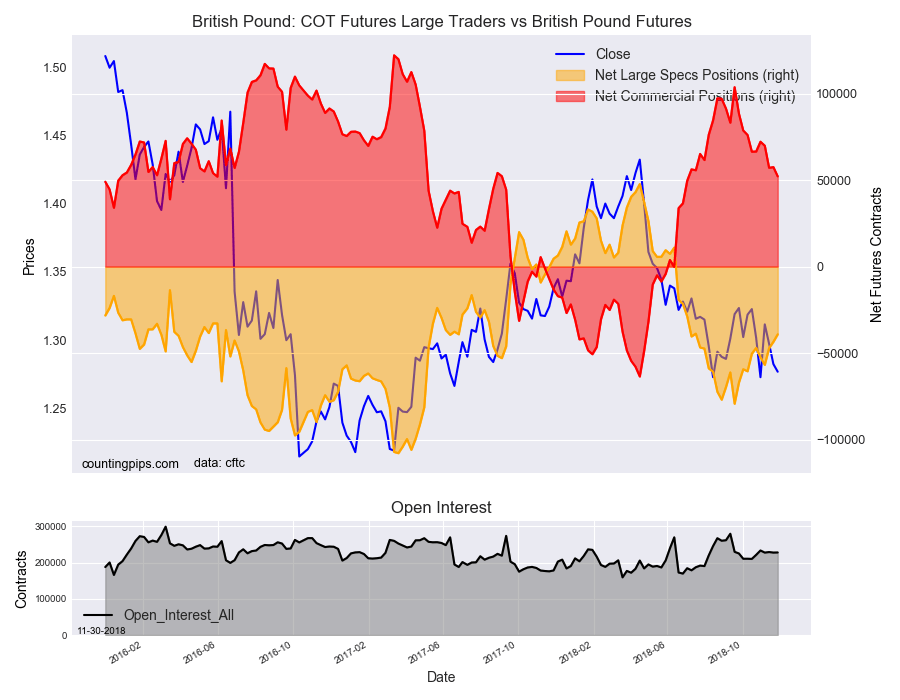

British Pound Sterling:

The large British pound sterling speculator level reached a net position of -39,150 contracts in the data reported this week. This was a weekly increase of 4,328 contracts from the previous week which had a total of -43,478 net contracts.

Japanese Yen:

Large Japanese yen speculators equaled a net position of -104,324 contracts in this week’s data. This was a weekly change of -4,259 contracts from the previous week which had a total of -100,065 net contracts.

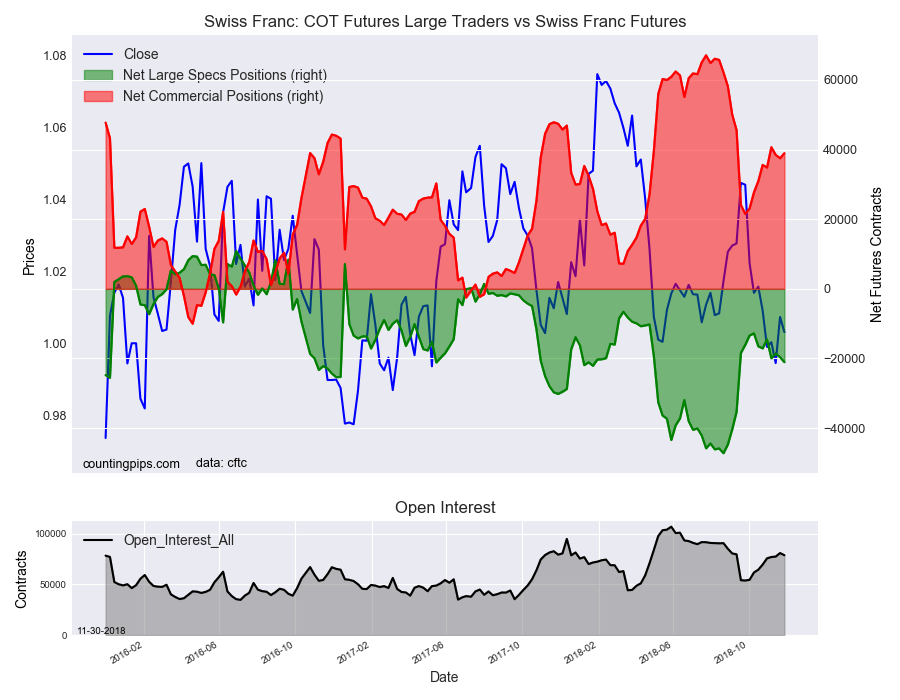

Swiss Franc:

The Swiss franc speculator standing this week equaled a net position of -21,068 contracts in the data through Tuesday. This was a weekly change of -1,443 contracts from the previous week which had a total of -19,625 net contracts.

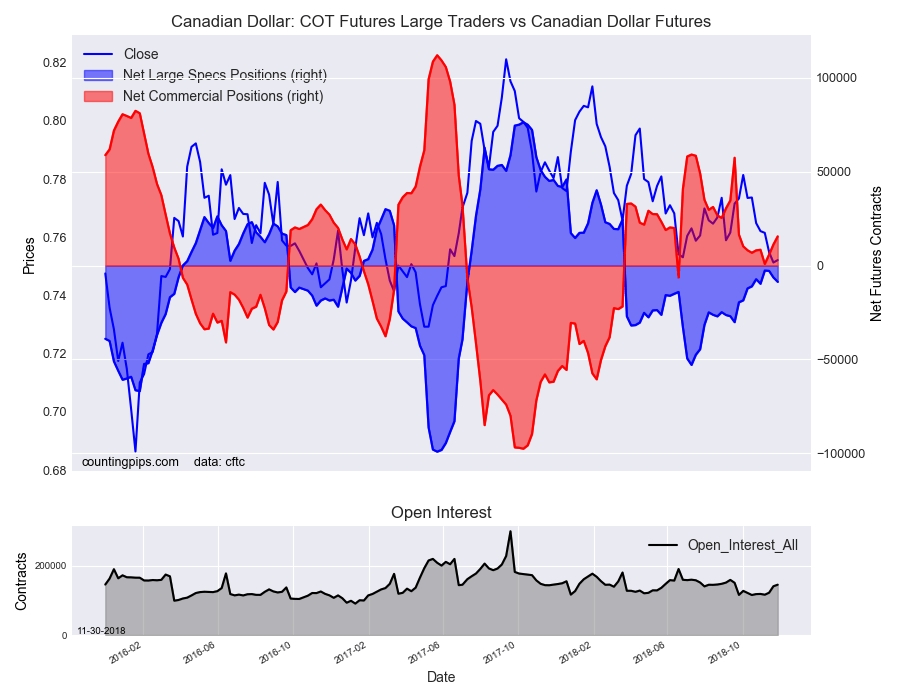

Canadian Dollar:

Canadian dollar speculators recorded a net position of -8,630 contracts this week. This was a change of -2,341 contracts from the previous week which had a total of -6,289 net contracts.

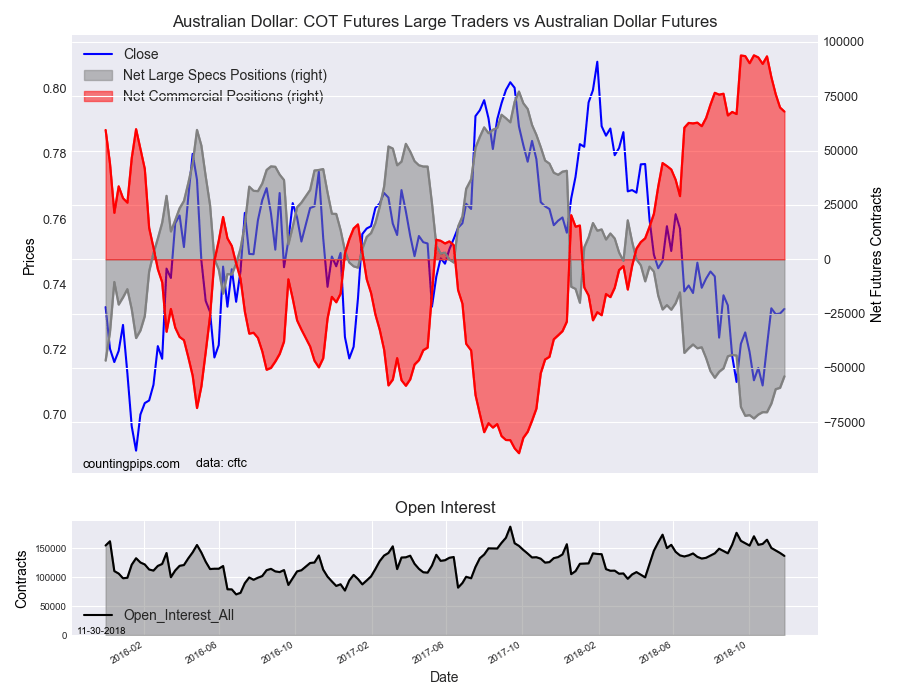

Australian Dollar:

The large speculator positions in Australian dollar futures reached a net position of -53,903 contracts this week in the data ending Tuesday. This was a weekly lift of 5,277 contracts from the previous week which had a total of -59,180 net contracts.

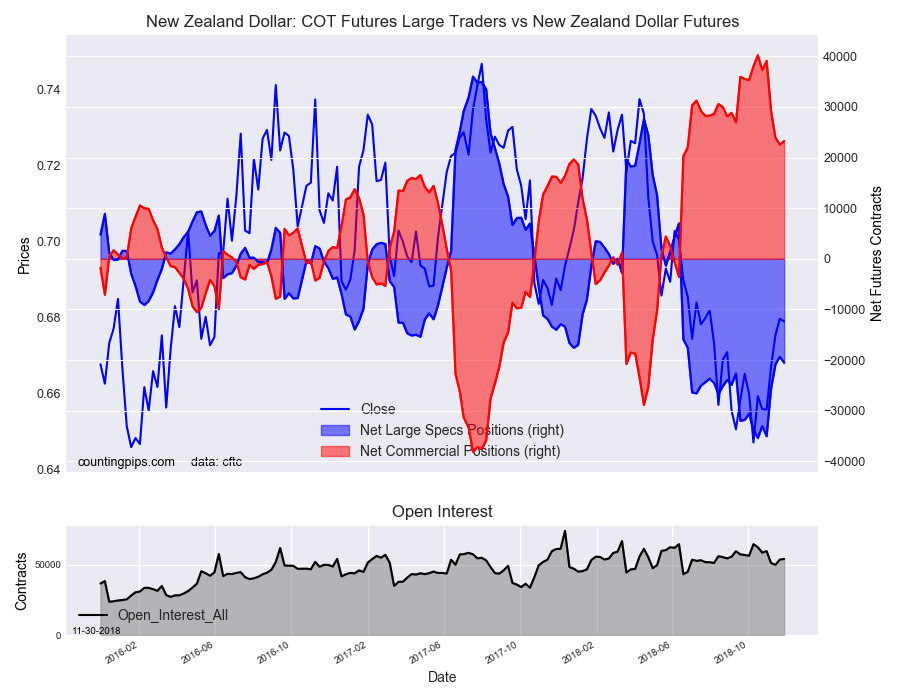

New Zealand Dollar:

The New Zealand dollar speculative standing resulted in a net position of -20,540 contracts this week in the latest COT data. This was a weekly decline of -1,193 contracts from the previous week which had a total of -19,347 net contracts.

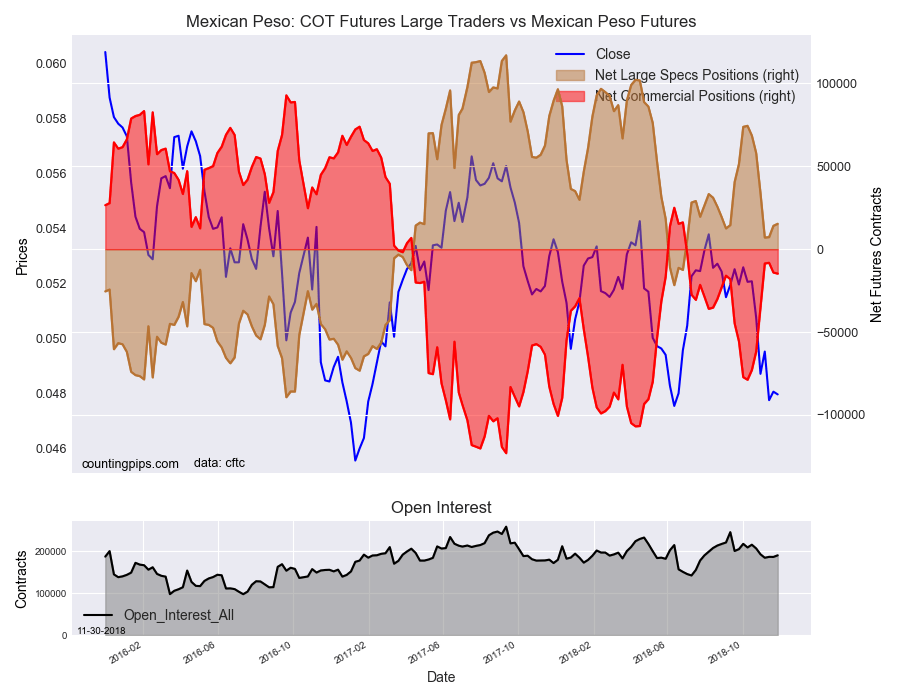

Mexican Peso:

Mexican peso speculators resulted in a net position of 15,327 contracts this week. This was a weekly increase of 1,244 contracts from the previous week which had a total of 14,083 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Dec 02, 2018 01:56AM ET

Source: Investing.com

By

By