The US$ remains weak but is currently at 96 S/R support so watch for any make or break here with today’s US GDP and / or Weekly Unemployment Claims data. Many of the trend line breakout trades from earlier this week have continued and the updated tallies are noted below. The best set up today though looks to be the 4hr triangle on the ASX-200!

USDX weekly: looking bearish but watch 96 for any make or break:

FX Index Alignment: The FX Indices are now aligned for ‘risk on‘.

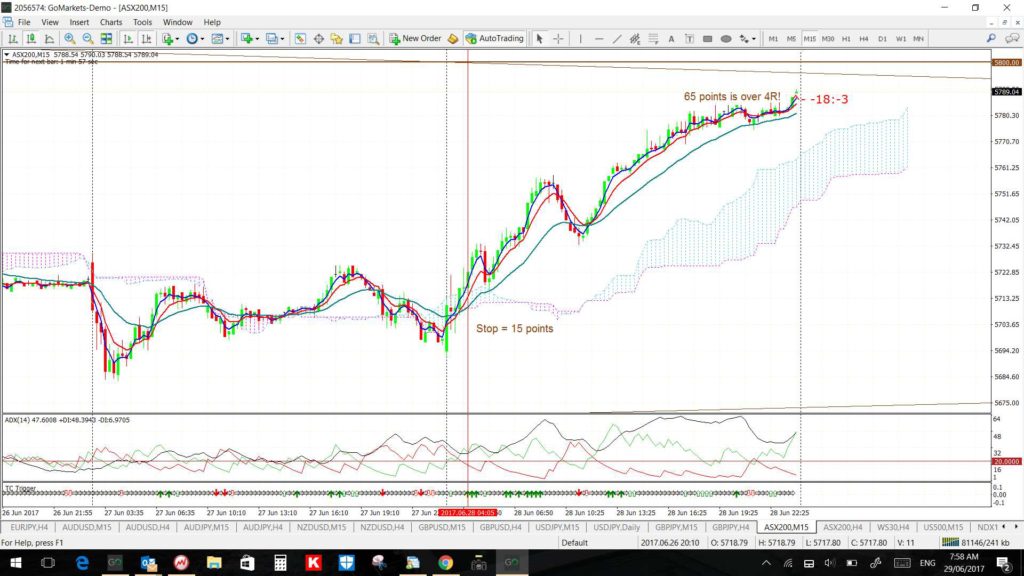

ASX-200: this is up testing a 4hr trend line but note the great 15 min chart TC LONG trade this gave yesterday for over 4R!

ASX-200 4hr: watch these trend lines for any new breakout:

ASX-200 15 min: chart from just after the TC LONG triggered on Wednesday:

ASX-200 15 min: today’s chart showing a 4R gain. Note the triangle trend line and major 5,800 level just above current price though:

Trend line breakout tally:

EUR/JPY: now at 340 pips:

AUD/JPY 4hr: now at 150 pips and note how price is at the daily chart’s triangle trend line so watch for any new make or break from here:

USD/JPY 4hr: now at 110 pips and also at another higher-order triangle trend line so watch for any make or break from here:

GBP/JPY 4hr: now at 370 pips:

GBP/NZD 4hr: spiked to 300 pips but is stuck at the 1.77 major S/R level so watch for any make or break from here:

EUR/AUD 4hr: still at 180 and struggling at 1.50 S/R so watch for any make or break from here:

EUR/NZD 4hr: spiked to 200:

Oil 4hr: now up 140 pips:

EUR/USD: this channel breakout is at 90 pips now.

E/U 4hr:

AUD/USD: a breakout underway? The 15 min chart gave a new TC LONG in the last session that is still open but has already given 3.5R:

A/U 4hr:

A/U 15 min:

Other FX:

NZD/USD 4hr: watch the Flag trend lines here:

GBP/AUD 4hr; I’m still struggling to read this one just at the moment:

USD/CNH 4hr: a breakdown starting?

USD/TRY 4hr: moving towards the apex of this wedge:

Commodities:

Gold 4hr: watch the wedge trend lines and $1,250 level. US$ weakness should help keep the metal supported but the flow into stocks, if this continues, will be asset allocation competition:

Silver 4hr: a bit choppy but might be breaking out to the upside?