The CAD/JPY was in my stable of pairs some years ago but has come back into focus with the current TC Trial. One of the TC Trial participants had a good trade on this pair last week so I thought I’d revisit the charts and here is what I’m seeing.

CAD/JPY monthly: there is a large triangle on the monthly chart but a smaller weekly triangle looks to have just broken to the upside. The 95 S/R level is worth noting here:

CAD/JPY weekly: a weekly triangle looks to have just broken and I note the 61.8% fib is up near the previous S/R level of 95 and so this would be an obvious target for any continuation move:

CAD/JPY daily: the 89 level is more recent resistance though so watch for any move up to test this region. Note, also, how the TC Trading System gave a new TC LONG here that has delivered 300 pips at this stage:

CAD/JPY 4hr: I have a Flag in place on the 4hr chart but notice how the TC Trading System gave a new TC LONG here as well that has delivered 380 pips giving a 3R trade thus far! Price has rallied for the last four weeks though and so some pause or pullback would not surprise as trends don’t travel in straight lines forever. Thus, keep an eye on the 4hr chart Fibs if there is such a move.

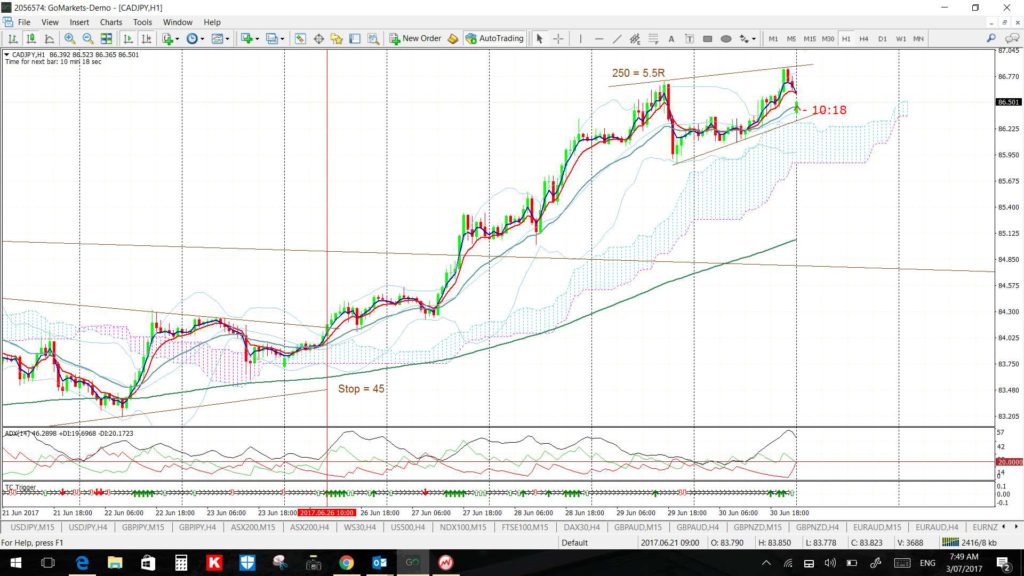

CAD/JPY 60 min: the TC Trading System gave a new TC LONG off the 60 min chart recently that has delivered 250 pips giving a 5.5 R trade and this signal is still open:

CAD/JPY 15 min: there was a 2R trade here on Friday off the 15 min TC system:

Calendar: keep an eye on both CAD and JPY news if trading this pair:

Summary: the CAD/JPY might be worth watching for any continuation move following the recent weekly-chart triangle breakout. Any bullish continuation would bring the 89 and then 95 levels into focus. However, price has rallied for the last four weeks so there could be some pause or pullback before any continuation move.