-

Benchmark index again approaches 6,000, level last seen in ’08

-

Wider All Ordinaries gauge trading at highest since May 2008

Australia, home to one of the worst-performing stock markets anywhere in the developed world this year, is finally poised to leave the financial crisis behind.

K2 Asset Management Ltd., whose fund has trounced the market, is betting financial and commodity companies will drive gains for equities Down Under. While many countries saw their local markets recently hit fresh record highs, Australia’s benchmark S&P/ASX 200 Index is only just approaching the highest level since 2008. Along with K2, Eight Investments Partners and Credit Suisse Group AG see earnings continuing to recover amid broader global economic growth and an improving outlook for commodity prices.

“Looking forward, the capacity for Australian companies to generate profits is quite good,” said Melbourne-based David Poppenbeek, whose K2 Australian Fund has outperformed its benchmark by a factor of almost two since starting in 1999 and now has 35 percent of assets devoted to financial stocks. “Jobs are being created and confidence is returning.” K2’s cut the cash portion of its A$470 million ($360 million) portfolio to buy more equities.

Profits for ASX 200 companies will grow another 6 percent in the year through June after expanding 15 percent in the previous period, according to Credit Suisse estimates.

Australia added more jobs than forecast in September, even as concerns over wage growth and consumer sentiment persist. The Reserve Bank of Australia has held rates at the lowest on record for more than a year, steering growth toward services as the economy transitions away from a mining-investment boom. It has also signaled it’s inno rush to join global peers in reining in stimulus even as the nation’s economy is improving.

Global Bull Run

The equity benchmark posted its best month this year in October, rising 4 percent amid a worldwide bull run. A broader measure of the local market reached a post-crisis high last week — the All Ordinaries Index, which tracks Australia’s 500 largest stocks, is trading at the highest level since May 2008.

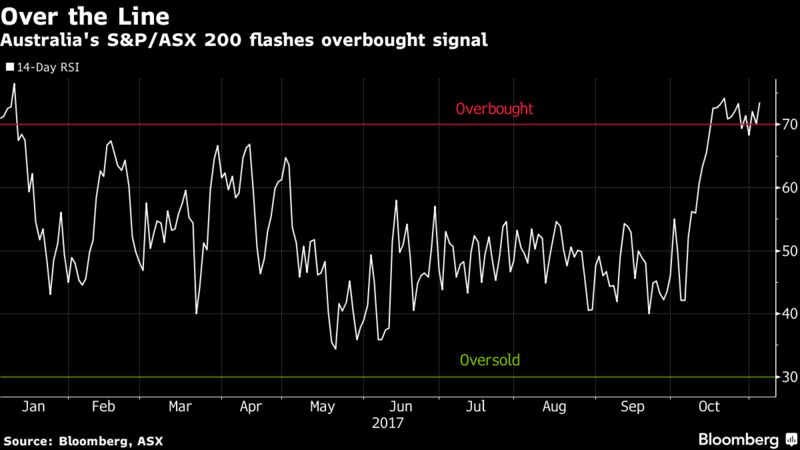

There are signs the market’s advance was too much too soon. The Relative Strength Indicator, a technical measure, has been suggesting stocks are poised for a drop.

“Statistically we are close to profit taking,” said Chris Weston, chief market strategist at IG Group in Melbourne. “Put no new money to work, wait for the pullback.”

The biggest contributor to October’s rally was the country’s largest lender, Commonwealth Bank of Australia, which posted record profit in August thanks to mortgage and business lending. Westpac Banking Corp., National Australia Bank Ltd., BHP Billiton Ltd. and Macquarie Group Ltd. rounded out the top five.

The biggest risk for the nation’s banks is a correction in property prices, but that scenario is unlikely, according to S&P Global Ratings. “Loan losses in the next two years are likely to remain very low by historical and international standards,” S&P saidFriday.

6,000

The ASX 200 previously approached the 6,000 level back in May and in 2015. Touching that level could spur more optimism around the 17-year-old measure, which was worse off than the S&P 500 in 2008 with a 41 percent decline.

Click here to read about why Australia’s stock market is smaller today than it was in 2007

“It is a significant level” that may bring further gains, said Kerry Series, who oversees A$250 million as chief investment officer of Eight Investments Partners in Sydney. “Stable economic growth and relative low bad debts, falling unemployment are positive for the economy and banks” while “synchronized global growth” will support commodity prices and miners. He’s betting smaller companies such as Cooper Energy Ltd. will outperform their larger rivals.

Still, the banks and the miners have the two highest weightings on index so their fortunes can determine the direction of the local stock market. For instance, a surprise bank tax announced in May helped trigger five straight months of losses for stocks.

Dividends

For some, the 6,000 level may just be a number. Reinvesting dividends, which play aprominent role in the local market, would have helped investors recoup losses from the financial crisis back in 2013, based on the performance of the S&P/ASX 200 Accumulation Index.

The lack of large technology stocks in Australia has limited the market’s performance this year. Tech firms, which make up less than two percent of the local benchmark, have led gains on the MSCI All-Country World Index, where they account for more than 17 percent of the global equities gauge.

The ASX 200 has climbed 4.7 percent this year in local dollar terms. In U.S. dollars, that advance is 12 percent, compared with 15 percent for the S&P 500 and 17 percent for the MSCI World. That relative under-performance has made the Australian measure cheaper, and possibly more attractive.

Consensus price targets for the index’s 200 members suggest the gauge will be at 6,040.59 in a year, according to data compiled by Bloomberg. Credit Suisse is more bullish. Strategist Hasan Tevfik expects the index to finish 2018 at 6,500, implying a 9 percent advance from Friday’s close.

By Abhishek Vishnoi