-

Equities decline in Europe, China as traders reassess outlook

-

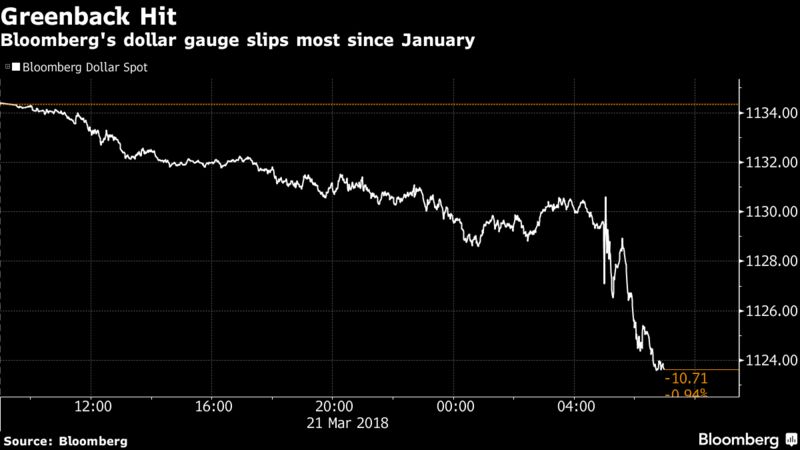

Greenback slides after Fed tightens rate path through 2020

Treasuries rose, the dollar extended losses and stocks slipped in Europe as traders assessed the implications of higher borrowing costs in the U.S. and China alongside global trade tensions, with President Donald Trump set to announce tariffs against Asia’s largest economy on Thursday.

The Stoxx Europe 600 Index declined a second day led by banking shares, and U.S. equity futures slipped. In Asia, Japanese and Korean stocks advanced while Hong Kong and Chinese shares retreated after China’s central bank also lifted market interest rates. The greenback sank against most of its G-10 peers as the Fed failed to live up to some predictions it would lean toward four rate hikes this year. The U.S. 10-year yield retreated while yields on two-year Treasuries, which are more sensitive to changes in Fed policy, also declined.

Federal Reserve officials, meeting for the first time under Chairman Jerome Powell, raised the benchmark lending rate a quarter point and forecast a steeper path of hikes in 2019 and 2020, citing an improving economic outlook. Investor focus now switches to trade, with Trump set to announce about $50 billion of tariffs against China over intellectual-property violations on Thursday, according a person familiar with the matter.

“The meeting was slightly dovish compared to what most market participants were expecting,” said Charlie Ripley, senior investment strategist for Allianz Investment Management. “A rate hike was certain, but lack of upward movement in the 2018 ‘dots’ left investors who were looking for a hawkish outcome unsatisfied.”

Elsewhere, oil pared gains that came after data showed crude inventories in the U.S. unexpectedly dropped, catching traders off guard. The Australian dollar slipped after the country’s unemployment rate climbed.

Terminal users can read more in our markets blog.

Here are some key events on the schedule for the remainder of this week:

- The Bank of England is expected to keep interest rates and its asset-purchase program unchanged on Thursday. Attention will be on language and the odds for a May hike, now seen as increasingly likely.

- Euro area flash PMIs come Thursday as well as Germany’s IFO gauge of business confidence.

- Philippines monetary policy decision is due Thursday.

And these are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index sank 0.6 percent as of 8:09 a.m. London time to the lowest in more than two weeks.

- The MSCI World Index of developed countries gained 0.2 percent, the largest rise in more than a week.

- The MSCI Asia Pacific Index gained 0.3 percent, the first advance in a week.

- The Shanghai Composite Index decreased 0.5 percent to the lowest in more than two weeks.

- Futures on the S&P 500 Index sank 0.5 percent to 2,703.50, the lowest in almost three weeks.

Currencies

- The Bloomberg Dollar Spot Index dipped 0.1 percent to 1,122.42, the lowest in a month.

- The euro rose 0.3 percent to the strongest in more than a week.

- The British pound gained 0.2 percent to the strongest in seven weeks.

- The Japanese yen climbed 0.4 percent to 105.65 per dollar, the strongest in more than 16 months.

Bonds

- The yield on 10-year Treasuries decreased three basis points to 2.85 percent, the biggest dip in three weeks.

- Germany’s 10-year yield fell two basis points to 0.57 percent, the lowest in almost two months.

Commodities

- West Texas Intermediate crude declined less than 0.05 percent to $65.16 a barrel.

- Gold gained 0.1 percent to $1,333.09 an ounce, the highest in more than two weeks.

By Adam Haigh and Todd White

March 22, 2018, 7:13 PM GMT+11

Source: Bloomberg